American Shipping Shrugs Off Harvey To Deliver Another Record in August

U.S. seaborne imports climbed 2% to a new record in August, Panjiva data shows. That was the sixth straight rise, to breach 1.07 million shipments, but it was also the slowest rate in a year due to disruption from Hurricane Harvey. Evidence of Harvey’s damage can be seen in a 2% slide in shipments from the EU and a 13% slump in Mexican exports by sea.

Shipments from Asia soared, with Chinese exports by sea to the U.S. climbing 7%. That may reflect a desire among exporters to avoid forthcoming protectionist measures from the Trump administration. A similar effect can be see in an 8% rise in automotive imports and 5% in iron / steel. The full year may see growth of 3% based on prior year patterns, with the stakes in the peak season being raised by further weather-based disruptions including Hurricane Irma.

U.S. seaborne imports increased by 2.1% on a year earlier in August, Panjiva data shows. That was the sixth straight increase, and resulted in a new record of 1.07 million shipments. The growth rate was the slowest in nearly a year, likely reflecting disruptions late in the month from Hurricane Harvey. As outlined in Panjiva research of August 29 this may have cut imports by around 6,500 TEUs per day, or 0.6% of the monthly total.

Source: Panjiva

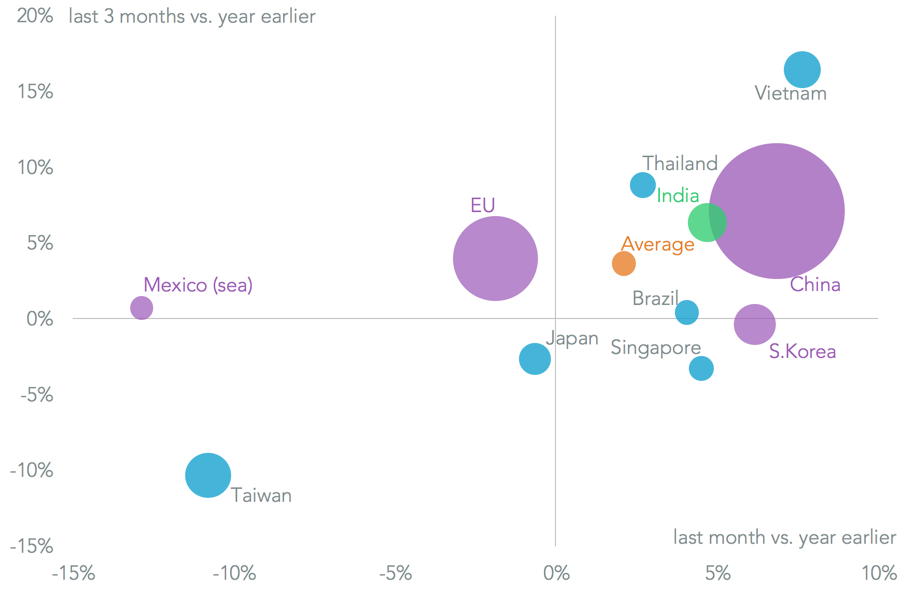

That is not to say that Harvey had no effect. Imports that head into the U.S. east coast dropped, including a 1.9% slide in shipments from the European Union – the first drop since December 2015 – and a 12.9% slump in those from Mexico by sea. Meanwhile shipments from Asia went from strength to strength. Imports from China climbed 6.9% and shipments from South Korea jumped 6.2%, possibly reflecting concerns about hawkish commentary on tariffs and trade deals from President Donald Trump.

Source: Panjiva

A similar pattern can be seen in tariff-sensitive sectors including autos (7.5% higher in the traditional slow month for the year) and iron/steel (which increased 4.7%). The latter represented a sixth straight rise, confirming the cost of delay in decision-making regarding the administration’s section 232 reviews of the steel and aluminium sectors.

Discretionary consumer goods meanwhile saw a downturn, with apparel falling 1.7% and toys by 8.5%, though furniture continued to buck the trend with a 10.5% rise.

Source: Panjiva

Looking ahead to the full year growth of 3.2% to reach 11.5 million shipments should be possible, based on prior year’s patterns. These have typically included shipments in September that are lower than August – reflecting the timing of the peak shipping season. Last year the pattern was distorted by the failure of Hanjin Shipping at the end of August. This year Hurricane Irma may have a similar effect – it may disrupt 10,600 TEUs per day – raising the stakes for the shipping industry in October.

Source: Panjiva

This report first appeared in Panjiva Research on 9/11 – please email sales@panjiva.com for more details.