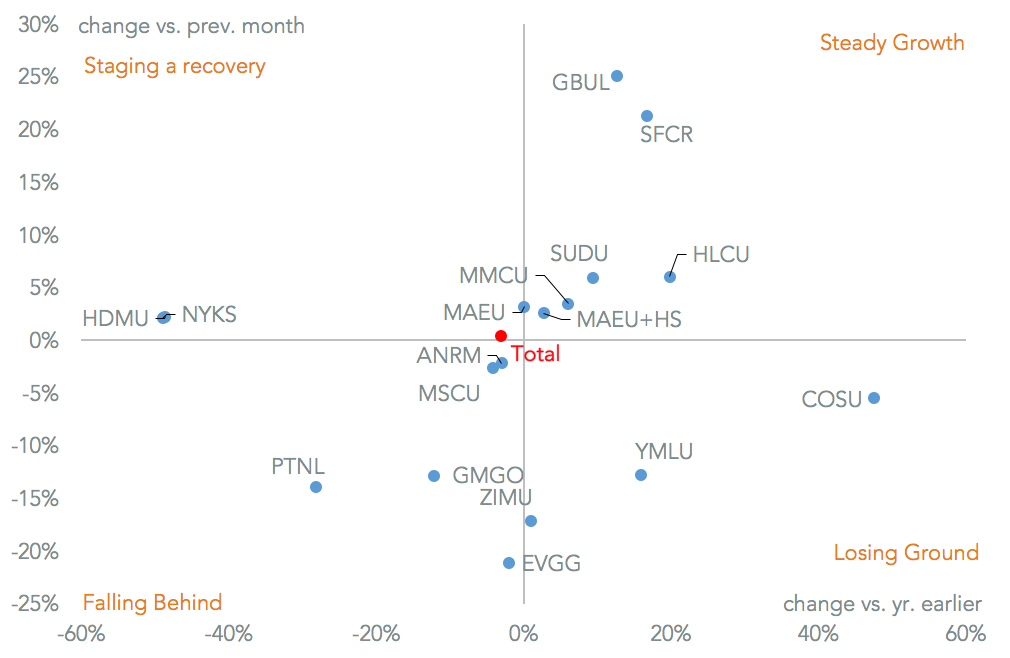

Brazil’s trade situation took another step backwards in October, with exports falling 14.5% on a year earlier, as discussed in Panjiva research of November 1, due in large part to weaker harvest conditions. This resulted in a drop in goods handled by shippers of 3.0% as export shipments fell 7.9% and imports increased only 1.6% according to Panjiva data.

This shortfall in volumes resulted in fierce competition among shippers. Those that lost out, when comparing to a year earlier, were NYK Line (perhaps distracted by its merger with Mitsui OSK and K-Line) and Hyundai Merchant Marine. By contrast both Cosco and Yang Ming built volumes on a year earlier whilst sliding compared to a month earlier. The good news for all of them is that exports rebounded in November.

Source: Panjiva

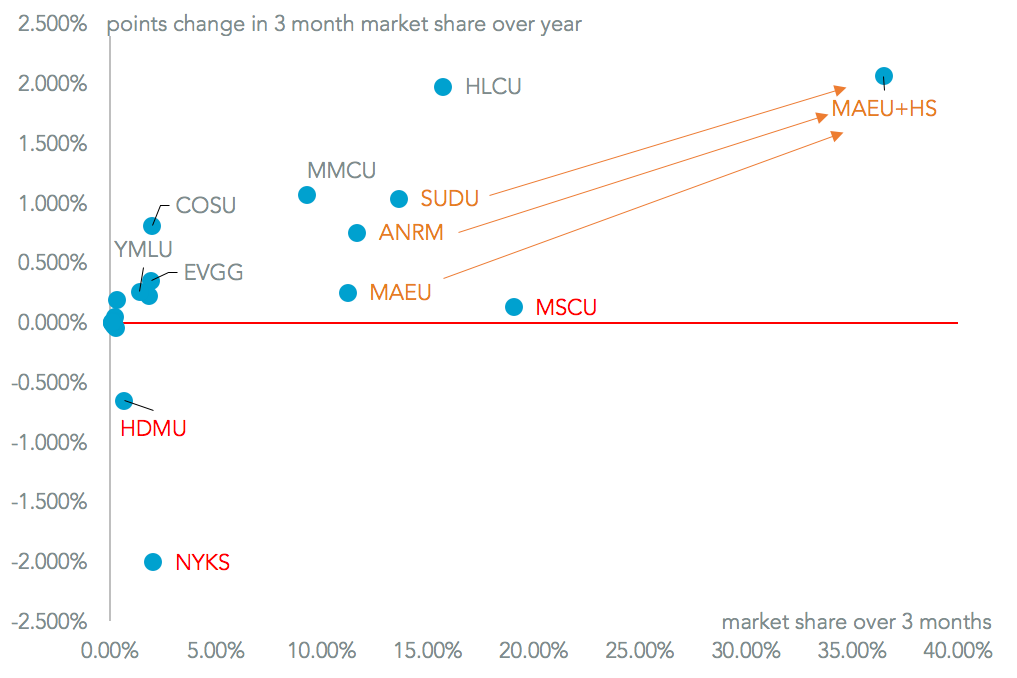

The consolidation of market share seen throughout this year continued. A simple point of evidence is that there were 112 shippers active on the export side in October 2016 compared to 149 in October 2015. That process has seen the top six players, of which CMA-CGM is the smallest, take an aggregate 5.22% points of market share, to reach 80.5%, in the three months to October 31 on a year earlier. Two of the biggest losers over the same period were NYK and Hyundai Merchant Marine.

The much bigger change to come, however, is Maersk’s proposed takeover of Hamburg Sud, which will also give it control over Alianca too. The combined entity would have had a 36.6% share over the past three months. When added to MSC within the 2M Alliance the combined group would have a 55.5% share of all Brazilian shipping. While the deal is not due to complete until the end of 2017 it would not be a surprise to see it being challenged from a regulatory perspective.

Source: Panjiva