India’s pharmaceuticals sector is its third largest export industry after oil products and apparel, Panjiva data shows, accounting for 5.8% of shipments in the past 12 months. It has been in something of a decline, however, with a 1.3% slide in exports in dollar terms in the past year. A similar slide in the past quarter has meant the sector has lagged the broader growth in national exports, as outlined in Panjiva research of September 18.

Source: Panjiva

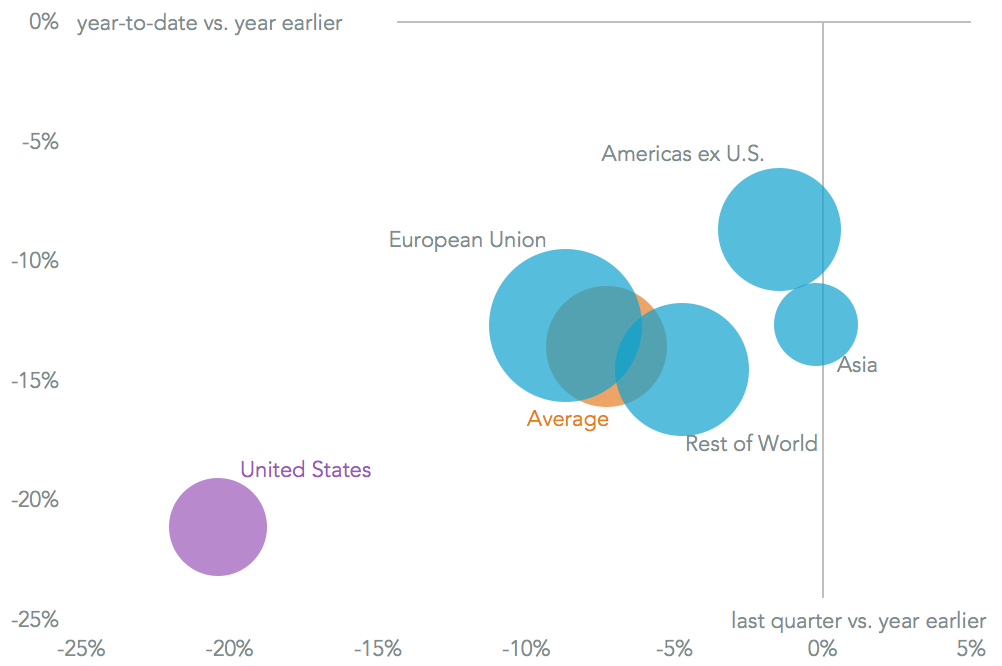

A large part of the decline can be seen in the decline in shipments from India, with a 7.3% drop in the quarter to July 31 and 13.6% slide year-to-date. The biggest challenge has come from the biggest individual national market, with shipments to the U.S. having fallen by 20.4% in the past quarter while exports to the EU have fallen by just 1.5%.

Source: Panjiva

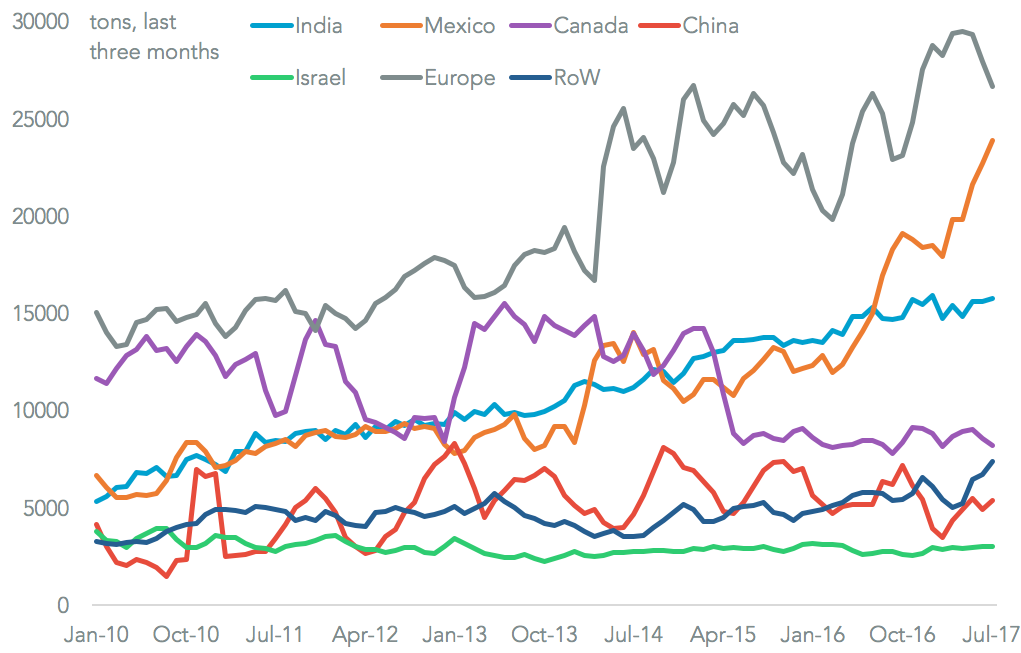

In part that reflects a loss of market share in the U.S. for Indian-based manufacturing vs. that in Mexico. Looking specifically at packaged medicines – ie excluding precursors – total U.S. imports, by volume, climbed 14.7% in the three months to July 31, while shipments from Mexico jumped 59.2%. On top of that there is also ongoing pressure on drug prices in the U.S., which is making itself felt in the generic drug sector where Indian companies have their main presence.

Source: Panjiva

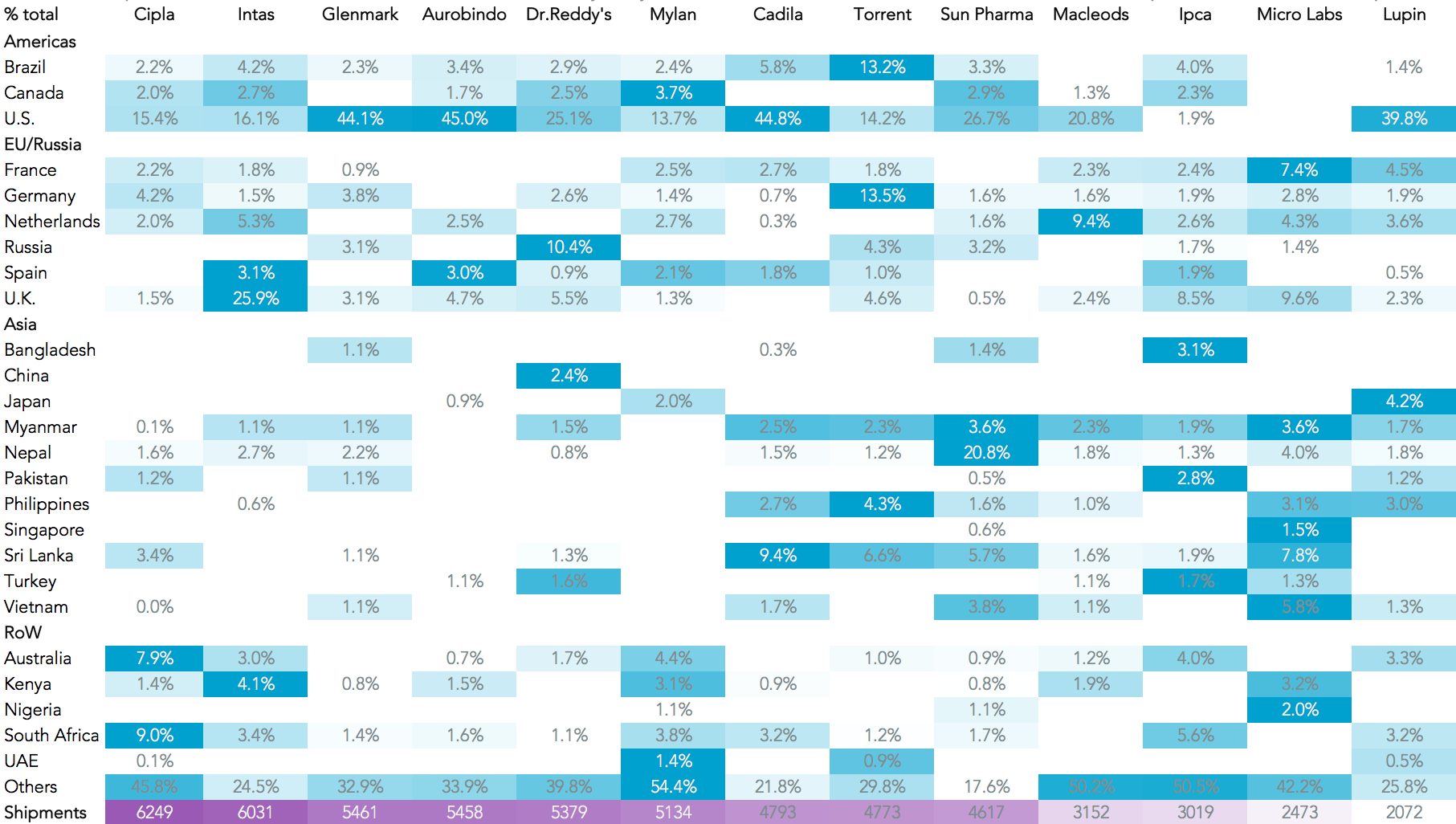

Those pressures are leading the Indian manufacturers to look for alternative markets. Panjiva analysis of over 2,300 company-country pairs shows the most exposed manufacturers to the U.S. – and therefore most in need of diversifying – are Aurobindo (45.0% of the total), Cadila (44.8%) and Glenmark (44.1%). Mylan, Macleods and Ipca meanwhile all send over 50% of their shipments to markets outside of the top 20 globally. Sun Pharma finally has the widest spread countries supplied to – at 19 of the top 20 – though it has a significant (20.8%) exposure to neighboring Pakistan.

Source: Panjiva