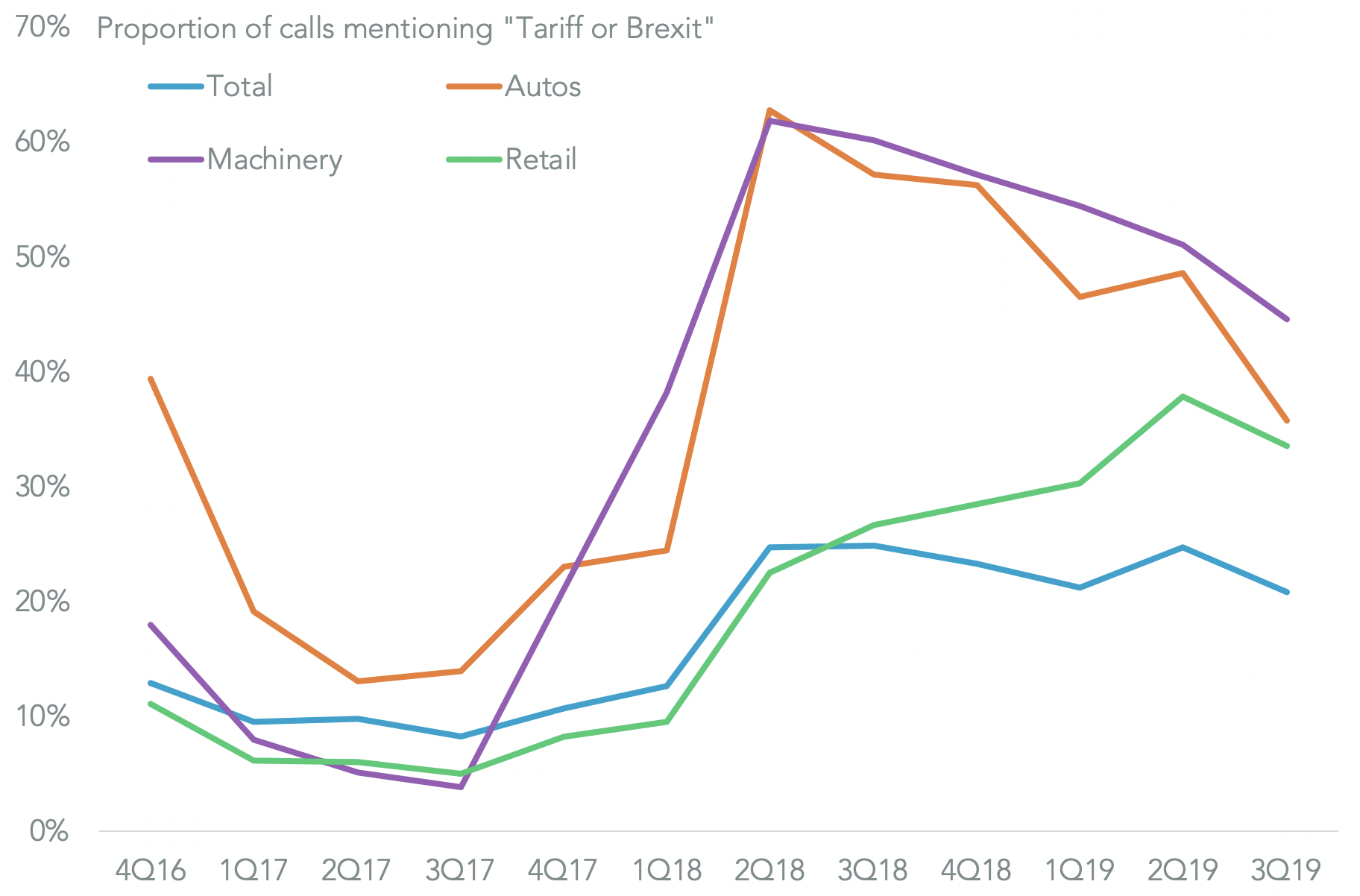

Corporate concerns about trade policy may be waning. Panjiva’s analysis of 7,549 company conference calls retrieved via S&P Global Market Intelligence since Oct. 1, 2019 shown that only 20.9% of firms discussed Brexit or tariffs. That was down 3.8% points compared to the prior three months and was the lowest level of mentions since 2Q 2018.

The fastest declining sector was autos with a drop to 35.8% from 48.6%. That likely reflects the delayed section 232 review of the sector, as outlined in Panjiva’s research of Dec. 10. The second fastest drop was in the machinery sector with 44.6% of companies mentioning the topics, down from 51.1% in the prior quarter. That still gave it the highest proportion of mentions.

The arrival of a phase 1 trade deal between the U.S. and China won’t make a meaningful difference to tariffs in the machinery sector, but it will for retail with list 4A tariffs cut to 7.5% from 15.0%. Despite that there was still a drop to 33.5% from 37.9% of firms discussing trade policy. Discretionary retail was higher than staples at 35.8% versus 30.4%, though the latter nearly doubled via the previous quarter – making it a rare outlier.

. Source: Panjiva

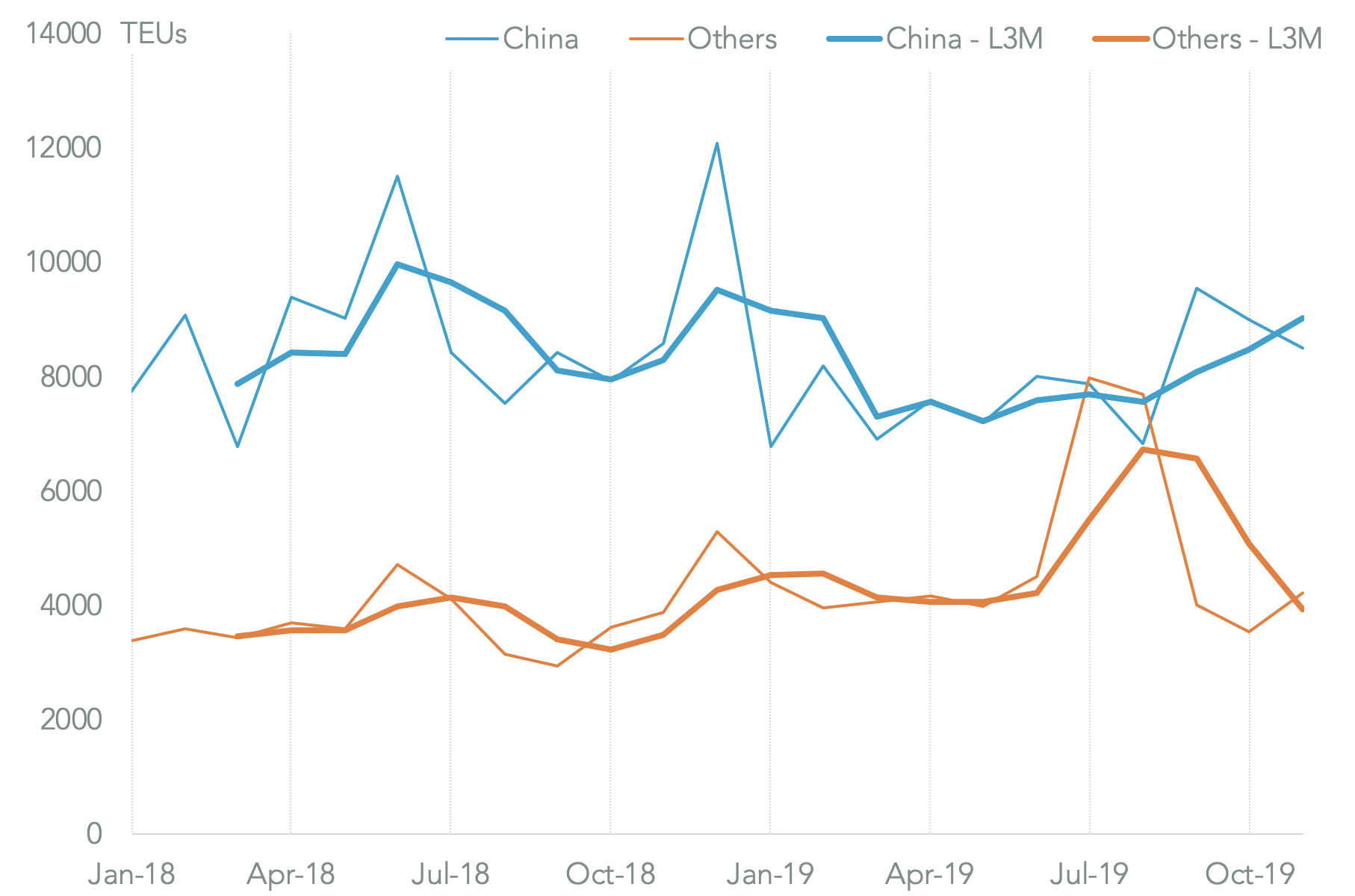

Diversified retailers have had to deal with tariff increases in both May and September this year. Many have coped but face ongoing challenges. For example the CFO of Costco, Richard Galanti, has stated that “we feel that we’ve had a relatively good mitigation plan“. That’s been driven by “our ability to move in and out of items” and the firm has “moved a few things where we can and sourced it from other countries“.

There may be limits to the process though and the firm’s “total China imports into the U.S. is about — is just a few percentage points lower than a year ago.” Making bigger moves for Costco and its competitors may not be possible with Galanti commenting “nobody can do a lot of that, nor can we.“

Panjiva data shows U.S. seaborne imports from China accounted for 69.7% of the total associated with Costco in the three months to Nov. 30, compared to 70.5% a year earlier just after list 3 tariffs were introduced. There were increased shipments in both September and October despite the imposition of list 4A tariffs, though they finally dipped 0.7% in November.

There was a small offset with an 8.8% rise in shipments from the rest of the world in November, potentially indicating renewed efforts to shift purchasing.

Source: Panjiva

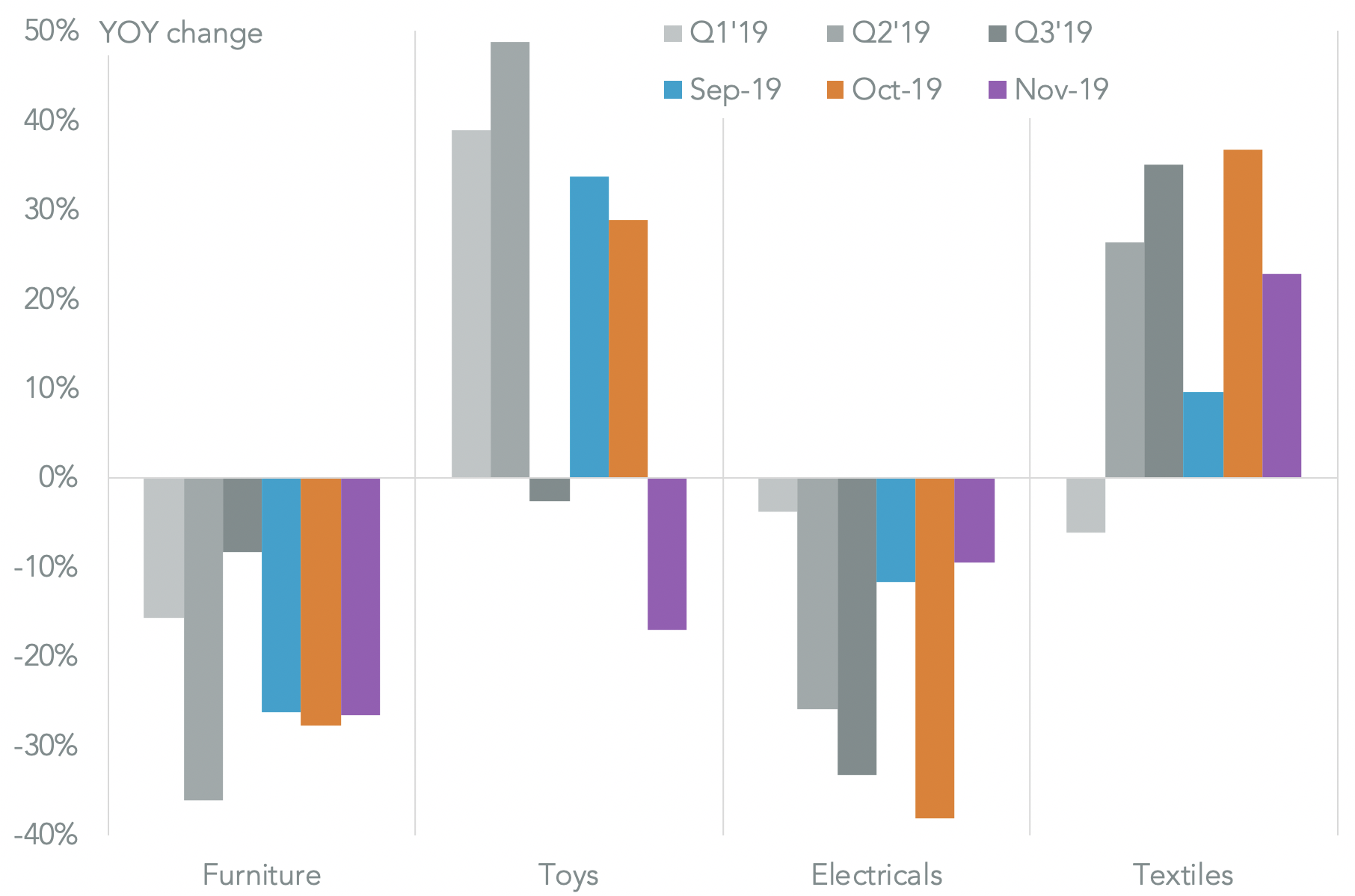

At the product line, Costco may have slashed its imports of furniture by 26.6% year over year in November, accelerating the 8.4% rate seen in 3Q. Similarly its imports of toys dropped 17.0% year over year in November after a pre-tariff boom in September and October following concerns that list 4B duties could be applied. The firm may also have been building up inventories to improve its competitive position – a move seen across the sector.

Imports of electricals ranging from appliances to consumer electronics fell 9.5% in November after a slump through most of the year. The outlier has been textiles which have steadily increased for most of 2019 so far.

Source: Panjiva

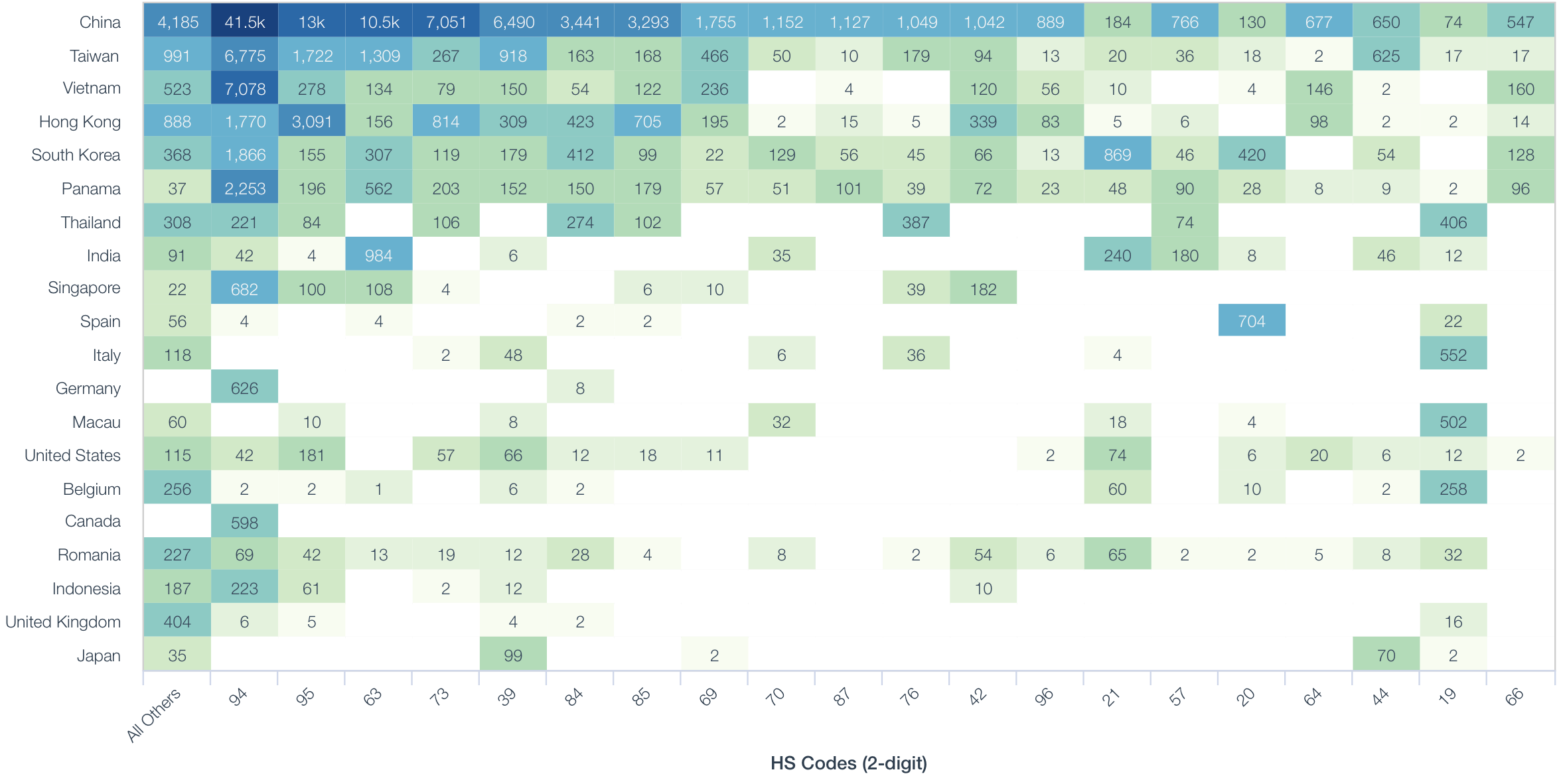

The change in mix of products by region can also be seen in imports of furniture which are dominated by China but also include Vietnam and Taiwan. Similarly imports of toys are also sourced from Taiwan and Hong Kong, while electricals are also imported from Taiwan, Hong Kong and Taiwan. Textiles finally are also imported from India.

Source: Panjiva