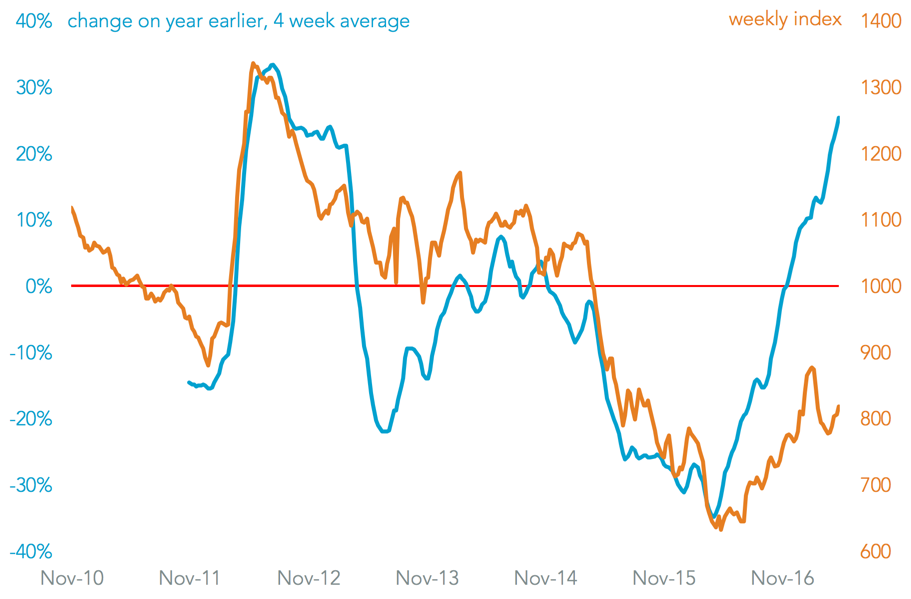

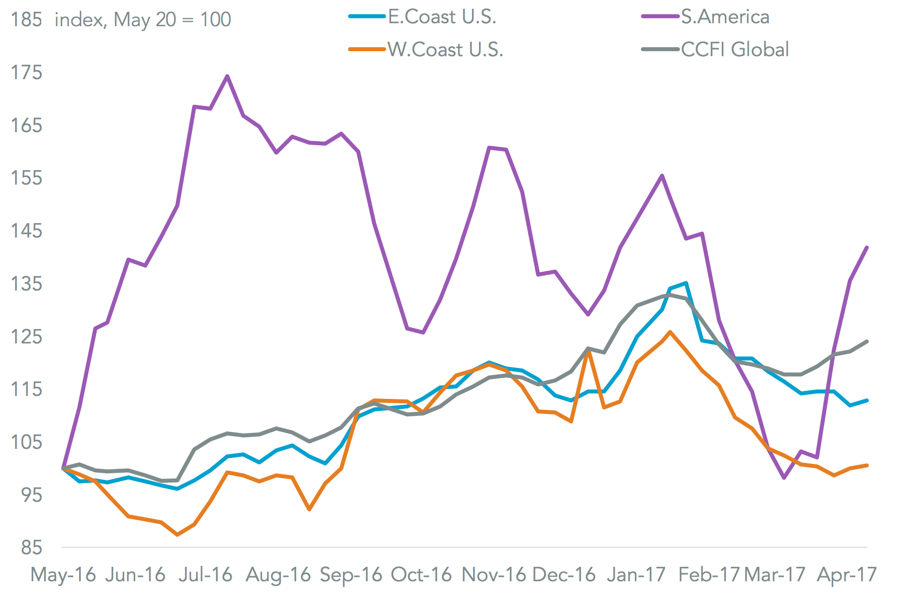

Container rates, measured by the Shanghai Shipping Exchange CCF Index, increased 5.2% during April. That reversed a 4.4% drop in March but still left the global index below its mid-February peak. On the face of it the recovery may support continued earnings growth for the container liners after an apparently solid first quarter, as outlined in Panjiva research of April 28.

Source: Panjiva

One challenge, however, is that rates on the major routes were broadly unchanged. China to east coast U.S. and west coast U.S. rates increased 1.4% and fell 2.1% respectively, while rates to Japan increased just 0.3%. The fastest rate increases were experienced on south American routes, which increased 18.9%, and those to the Persian Gulf which rose 27.0%. The former may be explained by the route disposal requirements required from the European Commission for its approval of Maersk’s bid for Hamburg Sud.

Source: Panjiva

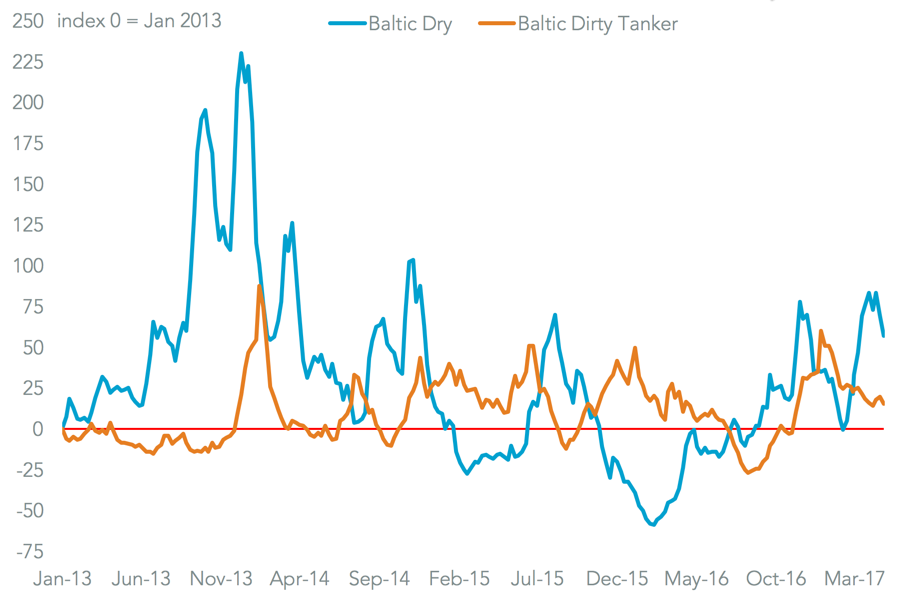

The rest of the shipping industry did not perform as well as container-lines. The Baltic Dirty Tanker Index fell by 1.6%, likely the result of a 2.5% slide in the WTI oil price. That may have been the consequence of President Donald Trump’s Executive Order, released at the end of the month, allowing increased U.S. oil drilling. Bulk rates meanwhile, shown by the Baltic Dry Index, dropped 14.5%.

Source: Panjiva

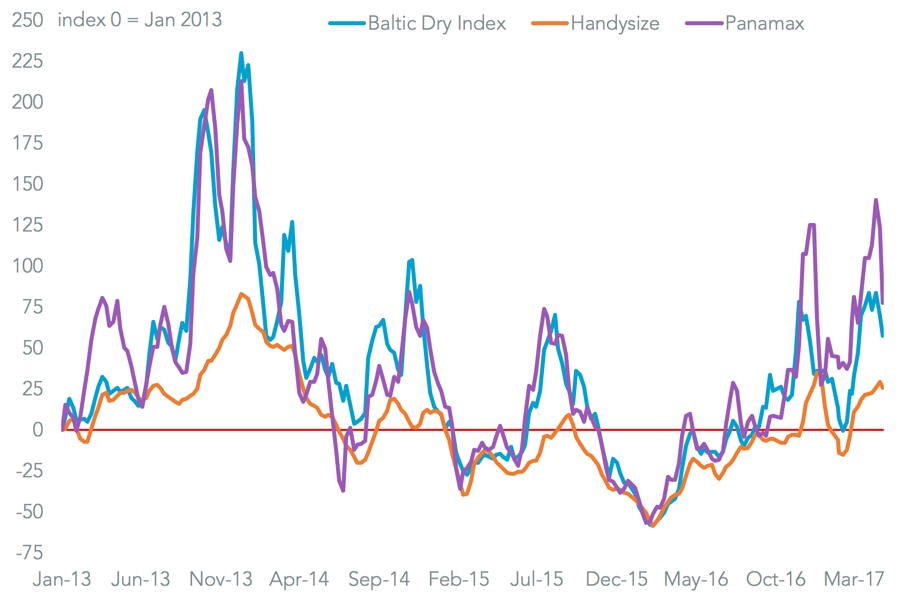

That decline was the result of a 26.3% drop in Panamax rates from their peaks in mid-April. Signals of an “uncertain” outlook from Pacific Basin management near the beginning of the month, and an interruption of the Panama Canal announced for May may have led to oversupply worries.

Source: Panjiva