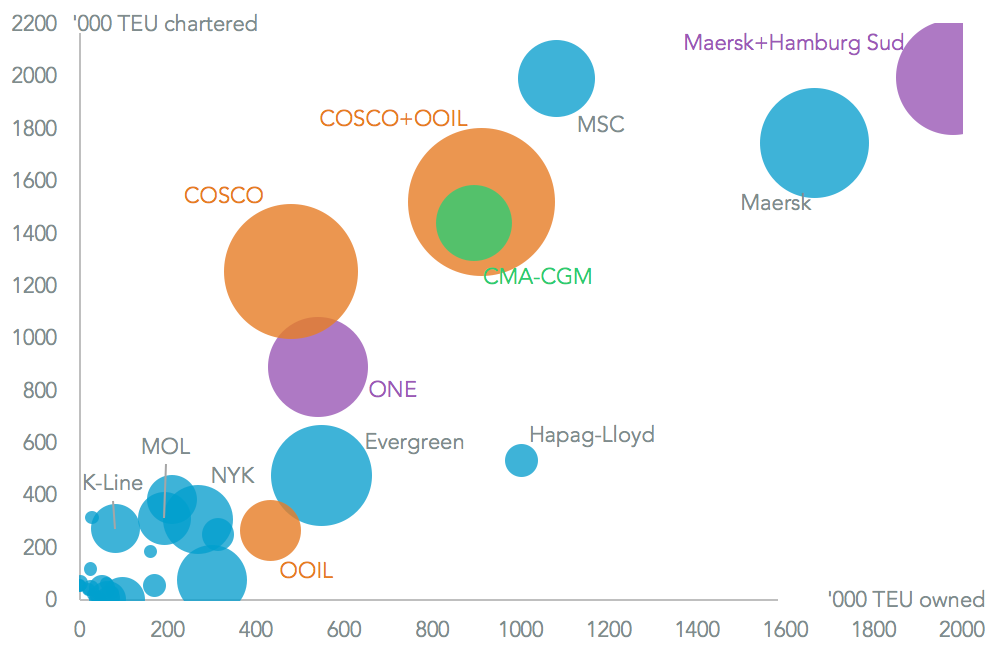

COSCO Shipping has announced plans to acquire Orient Overseas for HK$49.2 billion ($6.3 billion). The combined entity will be the third largest globally by capacity – including owned and chartered capacity currently in service, Panjiva analysis of Alphaliner data shows. The combined group will also have the largest expansion plans at 631,600 TEUs. Once all container-lines complete their current plans it will be just 5.6% smaller than MSC.

The biggest issue for the deal will be regulatory approvals. The company has so far not set a deadline for completing these. While the ONE grouping between the three Japanese shippers received approvals without significant conditions, as outlined in Panjiva research of June 29, others have not. Maersk’s purchase of Hamburg Sud has required Brazillian-route disposals as an example. In that regard COSCO Shipping’s deal may have a late mover disadvantage.

Source: Panjiva

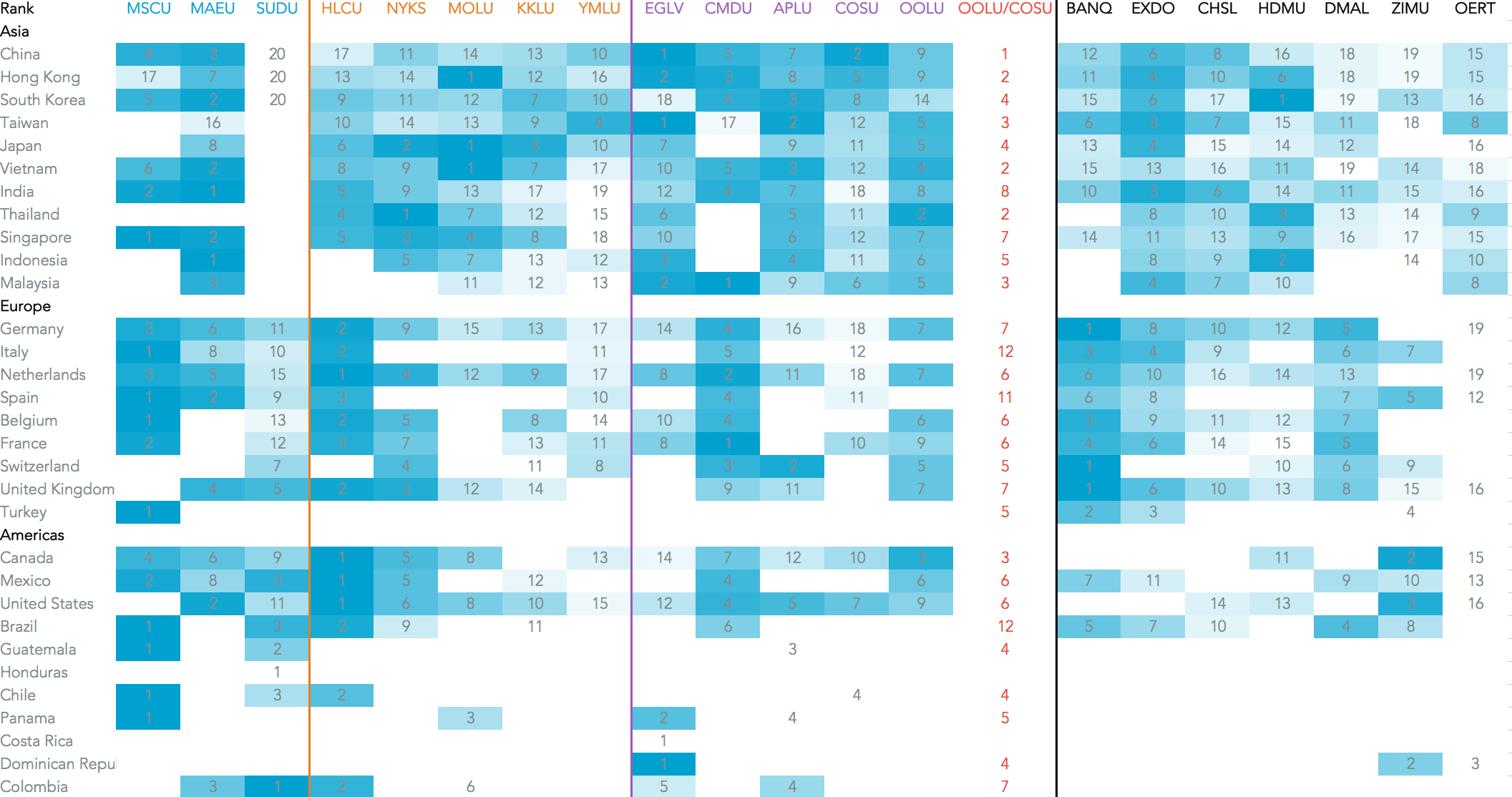

The deal is conditional upon U.S. regulatory approvals. The House maritime transport committee remains concerned about consolidation in the container-line industry. Panjiva analysis shows the combined entity would be a top three operator five major lanes from Asia including China (number one), Hong Kong (2), Vietnam (2), Thailand (2), Taiwan (3) and Malaysia (3). One complexity that should be avoided is that both groups are already part of the Ocean Alliance.

Source: Panjiva

Strategically the group refers to the ability to generate synergies (ie cost cutting or increased revenue opportunities) as well as long-term growth. In terms of cost cutting it does not appear that there will be a significant integration in the near term. COSCO Shipping have effectively committed to keeping Orient Overseas as a separate entity for at least the next two years after the deal’s completion.

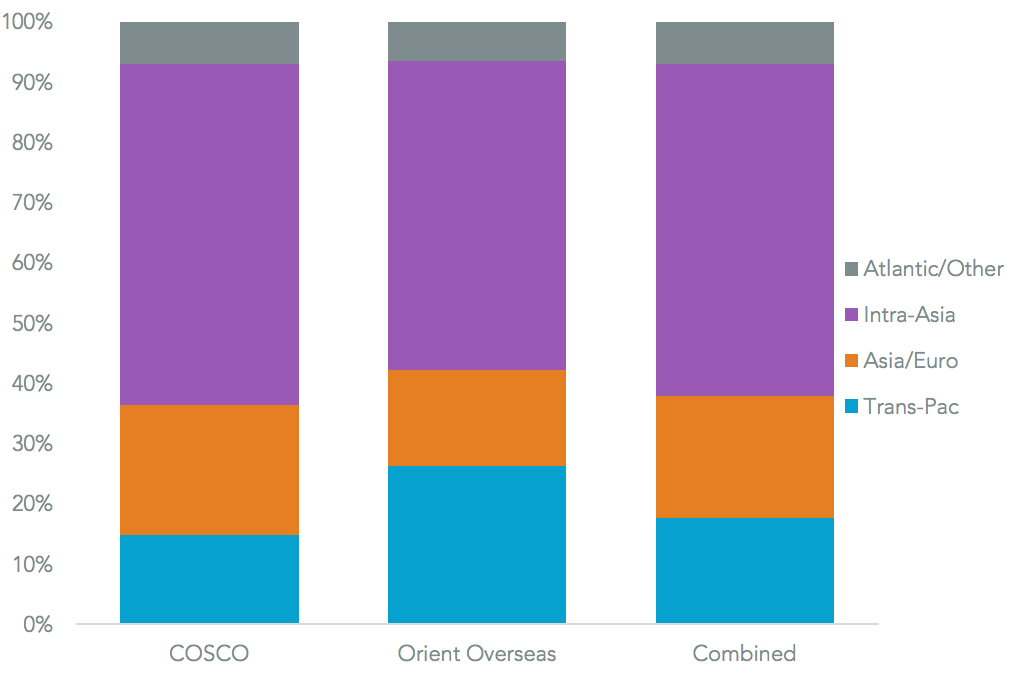

From a revenue perspective the “cross-selling” opportunities may be minimal. The two group’s revenues have a similar mix geographically. Panjiva analysis of COSCO and Orient Overseas’ financial reports shows. COSCO is slightly less exposed to Trans-Pacific traffic (14.8% of the total vs. 26.3% of Orient Overseas) but more exposed to Asia-Europe (21.6% vs. 16.0%). The move would not address shortfalls in both companies’ Transatlantic operations.

Presumably more details will emerge as the deal progresses through its regulatory approvals.

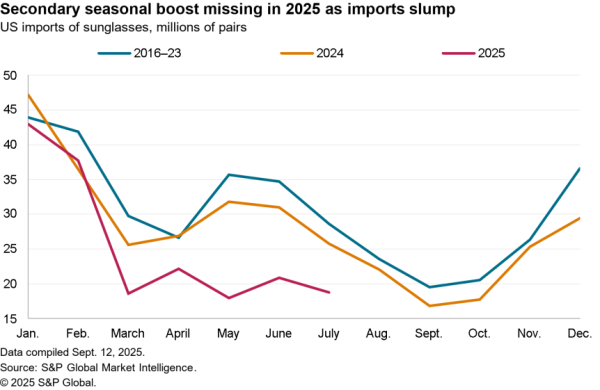

Source: Panjiva

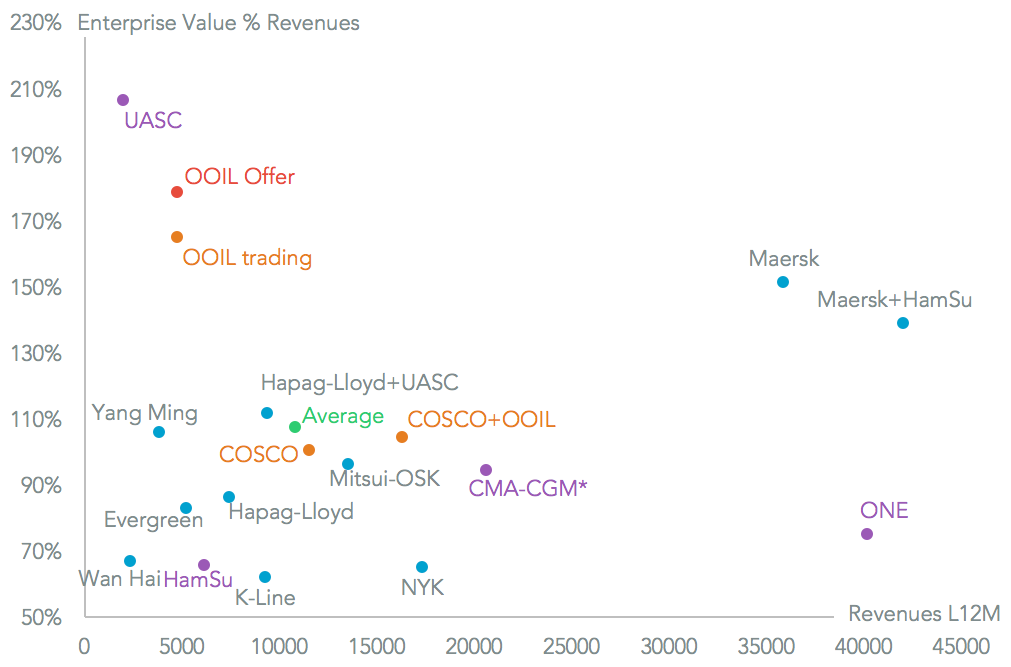

Financially the offer price of HK$78.67 was 38% above Friday’s closing price. Panjiva analysis of company financial data shows that the offer price is equivalent to a ratio of enterprise value (market capitalization plus net debt) vs. revenues of 179%. That compares to Hapag-Lloyd’s offer for UASC at 207%, Yildirim’s proposed sale of CMA-CGM at 94% and Maersk’s offer for Hamburg Sud at 65.6%. COSCO currently trades at a ratio of 101%.

It is worth noting that the shares currently trade 8.8% below the formal offer price. That may reflect concerns that the deal may not be completed, or including a “cost of carry” assuming an extended period to approve the deal.

Source: Panjiva

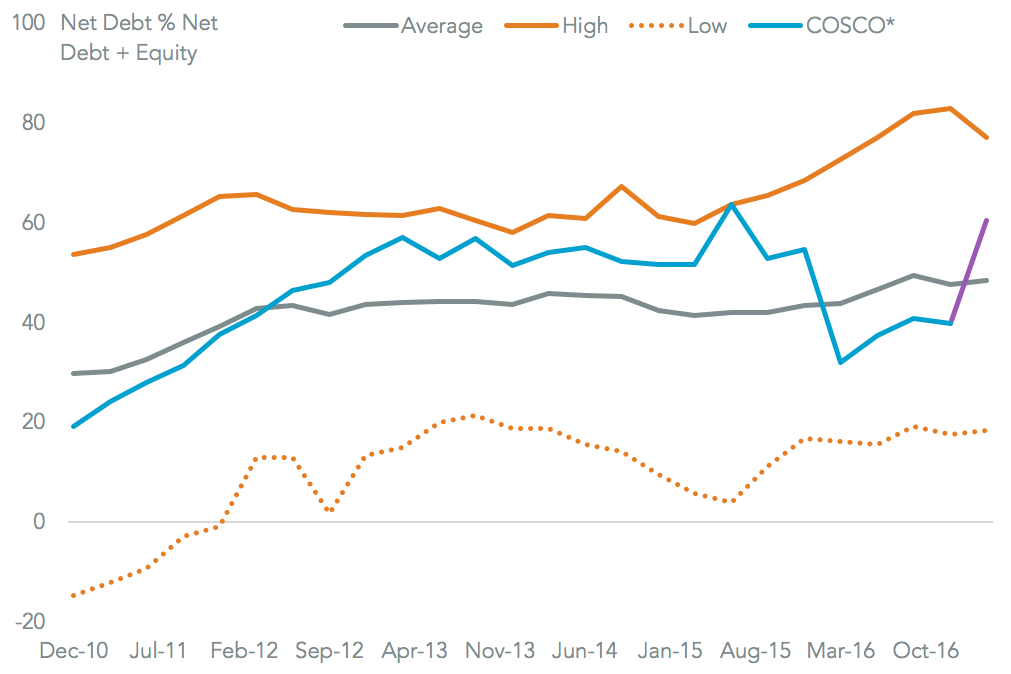

The deal will be full debt financed on COSCO Shipping’s part, though it has a co-investor who will take a 9.9% stake. That leaves COSCO Shipping needing to finance $5.8 billion of new debt on top of its existing $6.81 billion of debt and Orient Overseas’s existing $2.1billion. The resulting gearing, measured as net debt vs. total capital, will be 60.4%. That compares to COSCO Shipping’s 41.3% at the end of the first quarter and the industry average 48.4%. Credit rating company Lianhe currently rates the company’s debt as AAA with a stable outlook, the highest rating available.

Source: Panjiva