The Trump administration has issued an Executive Order declaring a National Emergency to tackle “the aggressive economic practices of certain non-market foreign producers of critical minerals have destroyed vital mining and manufacturing jobs in the U.S.” with China identified as a specific challenge. The EO specifically requires the Department of the Interior to report back within 60 days (Nov. 29) with recommendations for executive action.

The EO is just the latest in a series of orders and reports by the Trump administration in seeking to secure better access to critical minerals used in electronics and defense ranging from cobalt and rare earths to nickel and lithium. The process was kicked off by an initial Executive Order, outlined in Panjiva’s research of Dec. 2017, followed by a wider Defense Review in 2018 and a set of recommendations from the Commerce Department in 2019.

There are signs that the government is starting to take firm action even ahead of the Interior report, with the U.S International Development Finance Corp. making a $25 million investment in mine developer TechMet. That should give the U.S. government preferential access to Techmet’s development of cobalt and nickel reserves in Brazil.

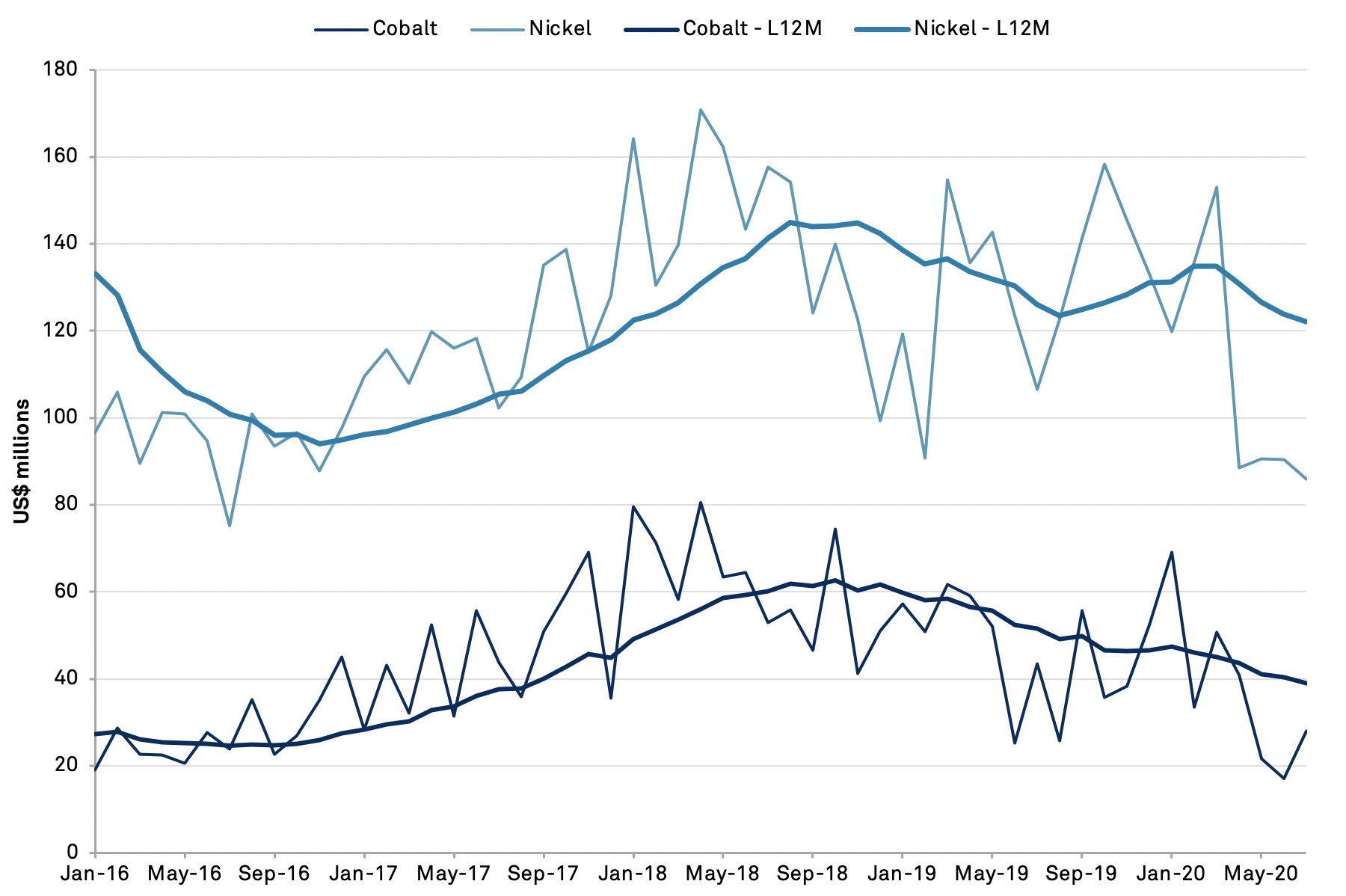

Panjiva’s data shows that U.S. imports of cobalt and nickel have grown by 10.5% and 7.4% respectively in the 12 months to July 31 versus calendar 2016 on a compound annual basis. Yet, there’s been a slump of 24.3% in cobalt imports and a 3.2% dip in nickel shipments in the past 12 months likely linked to manufacturing closures during COVID-19.

The direct exposure to China with the country representing just 1.3% of cobalt imports in the 12 months to July 31. The exposure to Russia is higher with 6.5% of cobalt imports and 8.9% of nickel with the vast majority of both being supplied by ally countries including Canada and Japan as well as suppliers from the EU and Norway.

Source: Panjiva

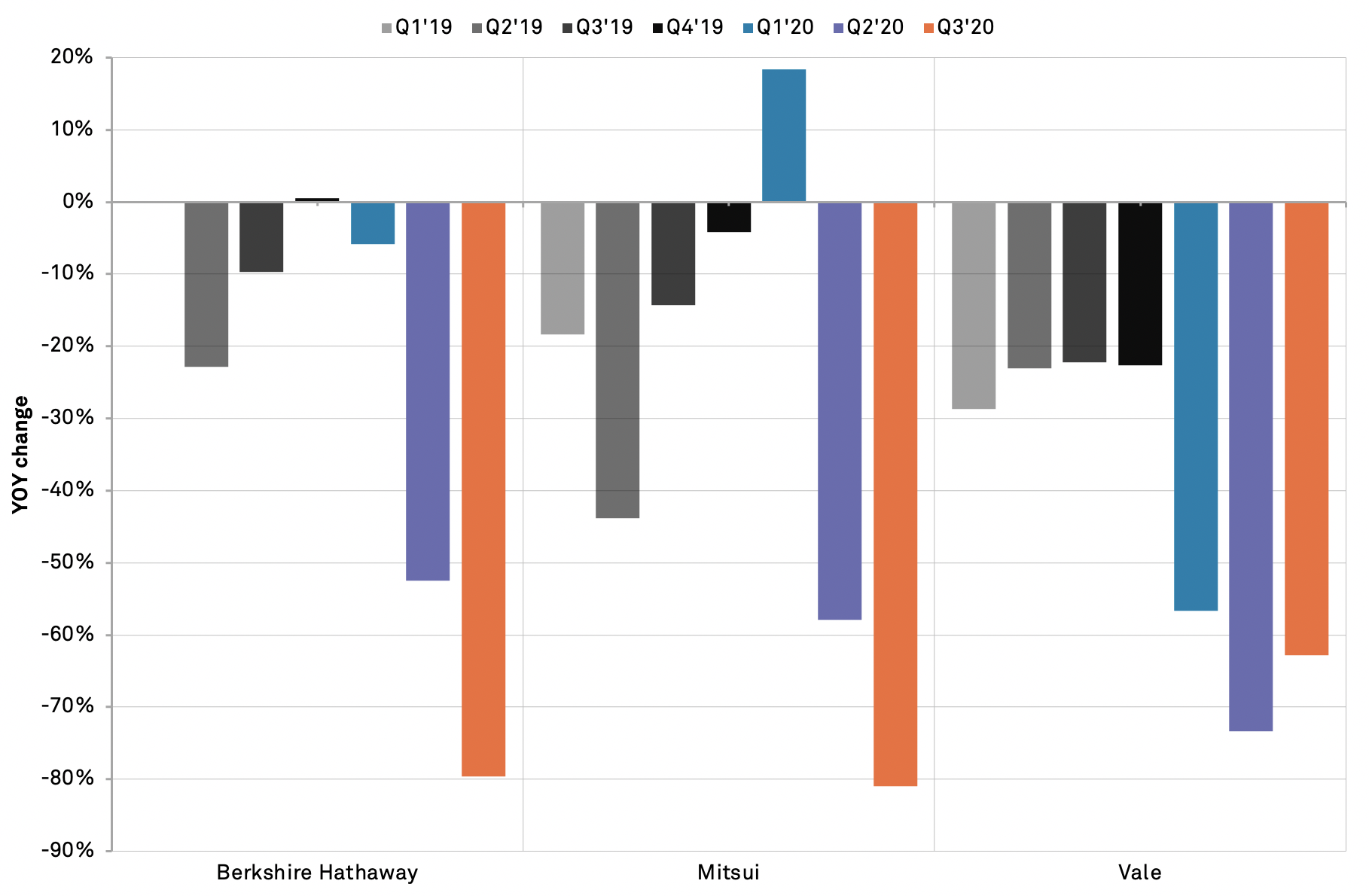

Unsurprisingly most of the major importers and suppliers to the U.S. have seen a drop in shipments. Panjiva’s U.S. seaborne data shows that imports linked to Berkshire Hathaway’s Western Australian Specialty Alloys dropped by 79.7% year over year in Q3’20 after a 52.5% drop in Q2’20. Similarly, shipments linked to metals trader Mitsui dropped by 81.0% in Q3 after a 57.9% slide in Q2 while imports associated with Brazil’s Vale slumped 62.9% lower in Q3.

Source: Panjiva