Japanese Prime Minister Shinzo Abe will visit Brussels on Thursday ahead of the G20 summit, according to the European Commission. That will likely be to sign a long-awaited trade deal between the EU and Japan, the Financial Times.

The deal would follow the U.S. withdrawing from the Trans-Pacific Partnership with Japan, and a stalling of Transatlantic Trade and Investment Partnership negotiations between the U.S. and the EU, as outlined in Panjiva research of May 31. Final passage may face challenges at the European Court of Justice, however, which may require EU member state approval.

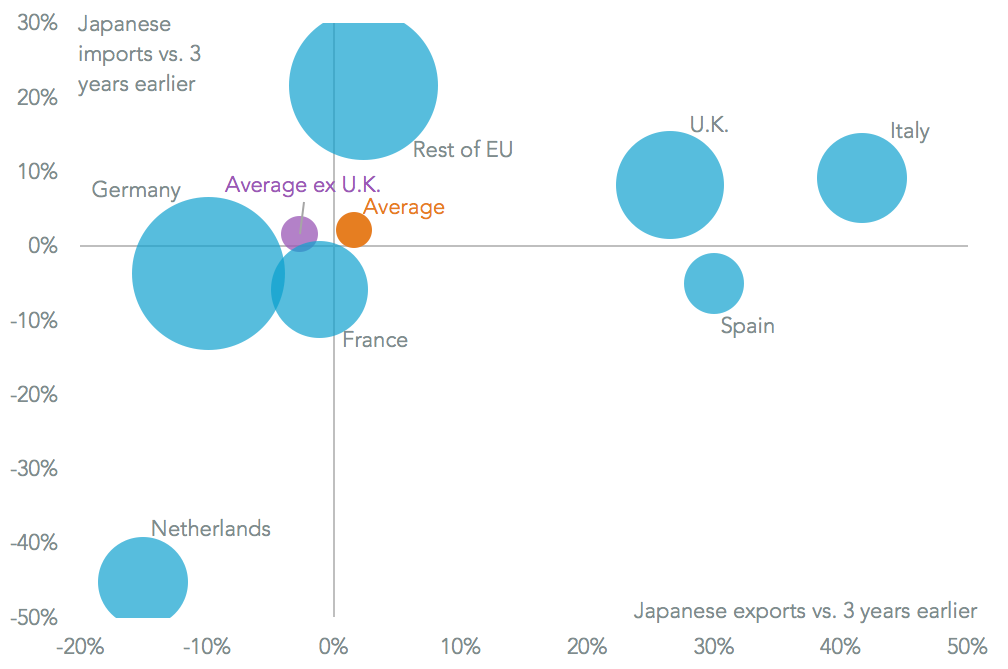

While the timing of the deal may be designed to send a message on continued commitments to trade liberalization, the economics of the deal may be compelling too. Japanese exports to the EU have increased by 1.6% in the past 12 months compared to three years earlier, Panjiva analysis of official data shows.

However, that includes a 26.5% jump in shipments to the U.K., which is leaving the EU – excluding the U.K. exports fell 2.7%. EU exports to Japan meanwhile increased 2.1%, but growth was led by smaller EU states, with shipments from Germany and France fell 3.7% and 4.9% respectively.

Source: Panjiva

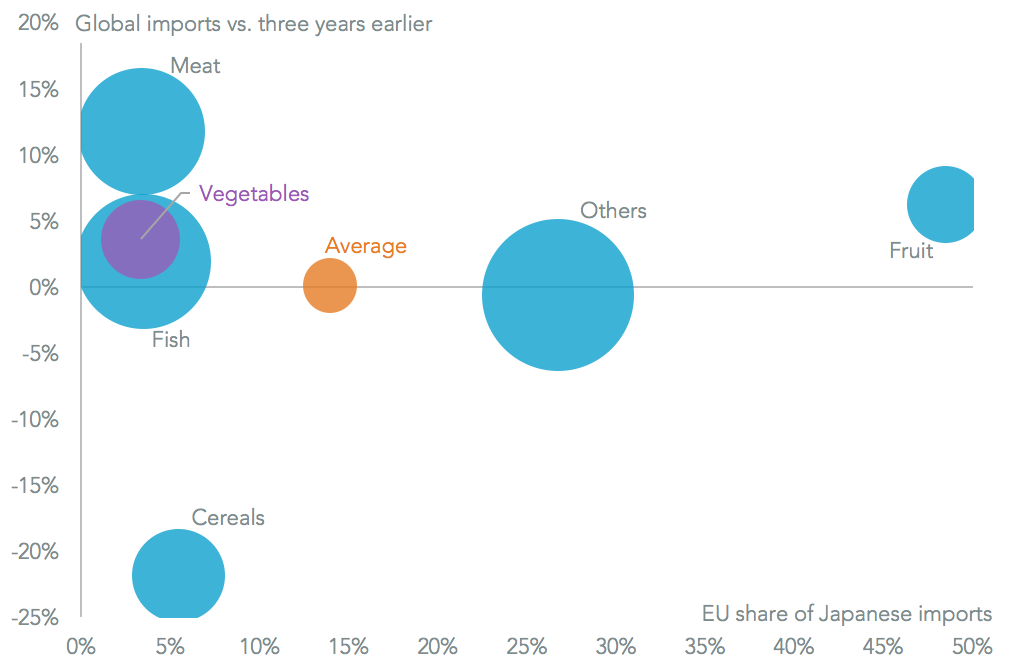

While the deal is likely to be a “modern” trade agreement including services, state procurement, investor disputes, regulatory equivalence and other non-tariff barriers to trade the most tangible benefits will be in straight tariff reductions. For the European Union one of the more significant “wins” will be in reduced agricultural and food tariffs. These averaged 14.5% in 2016, ITC data shows.

The biggest opportunity for EU farmers may be in the meat and dairy sectors. Japanese imports from all sources increased 11.8% in the past 12 months compared to three years earlier, while the EU accounted for just 3.4% of the total. On average Japanese food demand increased just 0.1% over the same period, with the EU accounting for 14.0%.

Source: Panjiva

For Japan the automotive sector could yield significant benefits. As well as being Japan’s largest export industry, it also faces 10% tariffs on exports to the European Union, European Commission data shows. A similar level is applied to other exporting countries, potentially giving the Japanese manufacturers an advantage if tariffs are cut. The benefit should not be overstated, however, as Japanese manufacturers already have significant manufacturing operations within Europe.

The EU has already proven to be one of the fastest growing markets for Japanese automakers in the past five years. Exports increased 6.1% annualized in the 12 months to May 31 on five years earlier, while the average increased by 4.8%. Over the past year it has also outpaced the U.S., which has begun to see a reversal of sales of imported vehicles. There could be further to go – Japanese exports to the EU are only 37.5% the level of U.S.

Source: Panjiva