The sixth round of NAFTA negotiations started informally on January 21 and are scheduled to run through January 29. The tone of negotiations is likely to be combative despite reports of . Canada has recently taken the U.S. to the WTO over its broad trade case policy – as outlined in Panjiva research of January 11. There are varying reports of whether the Trump administration will terminate the U.S. from the agreement. Mexican officials have threatened to withdraw from talks if the U.S. issues such a notice.

We continue to believe the automotive sector is the most important for the negotiations, accounting as it does for 69% of the U.S. trade deficit with Mexico and Canada as discussed in our 2018 Outlook. Rules of origin for the automotive sector are expected to be discussed from January 24, Politico reports, through January 29 when the ministerial component of the talks is scheduled to occur.

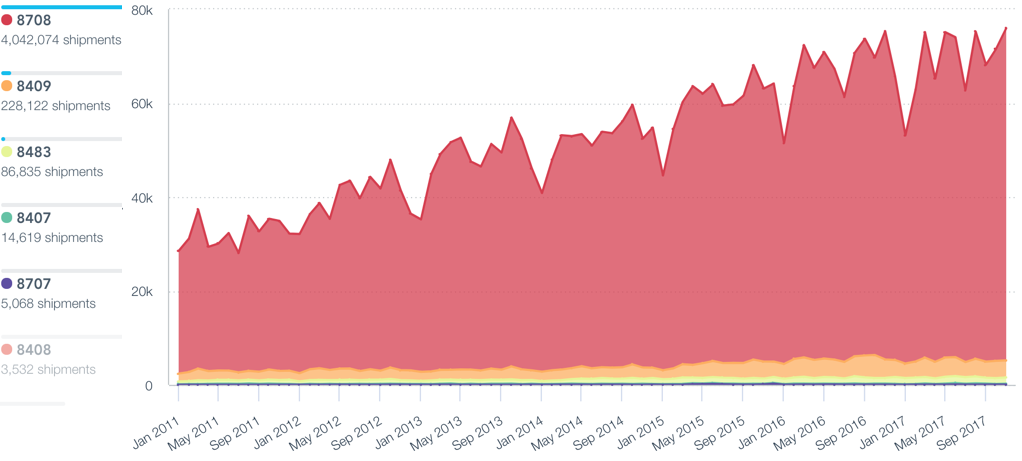

The automakers do not appear to be overly concerned about a proposed increase in the content requirements to 85% from 62.5% in the rules of origin in the aggregate yet. Seaborne imports of auto parts from outside NAFTA ranging from powertrains to interiors and semi-completed systems, climbed 3.1% vs. a year earlier in the fourth quarter and by 3.7% sequentially, Panjiva data shows. That would indicate little sign of stockpiling in the short-term. The reason may be an expectation that (a) NAFTA changes would take time to implement and / or (b) the bigger upheaval will be on intra-NAFTA supply chains.

Source: Panjiva

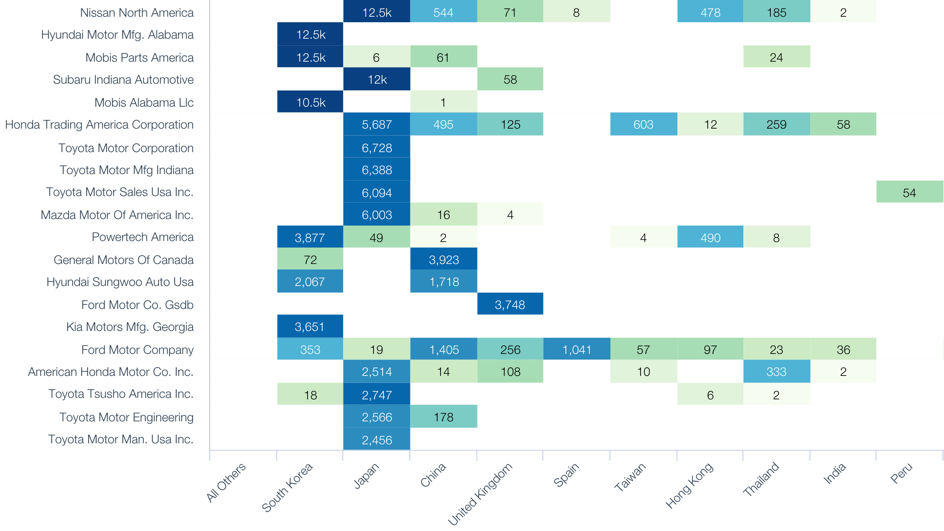

The largest direct importer of parts from outside NAFTA for assembly into vehicles into the U.S. in the past 12 months was Hyundai (35,500 TEUs) followed by Nissan (13,600) and Subaru (12,000 TEUs). The former ships wholly from South Korea while the latter two ship mostly from Japan. As such they will need to decide whether to bring parts manufacturing into the NAFTA region.

Source: Panjiva

Yet, the second part of the U.S. proposals – that 50% points of the 85% come from America specifically – does not appear to be causing concerns either. Exports of auto-parts from Mexico to the U.S. reached a new record in November, yet that was due to a rise of just 0.7% on a year earlier. Shipments in the prior three months had fallen 1.8%. That likely reflects a slowdown in sales of cars in the U.S. being a more important issue right now for automakers than regulatory uncertainty.

Source: Panjiva