President Donald Trump has threatened to close the U.S.-Mexico border in response to an anticipated surge in immigration from central and south America. While it is difficult to disinter formal policy from pre-midterm electoral politics such a closure – or even restricted entry and increased inspections – would have a significant effect on cross-border supply chains.

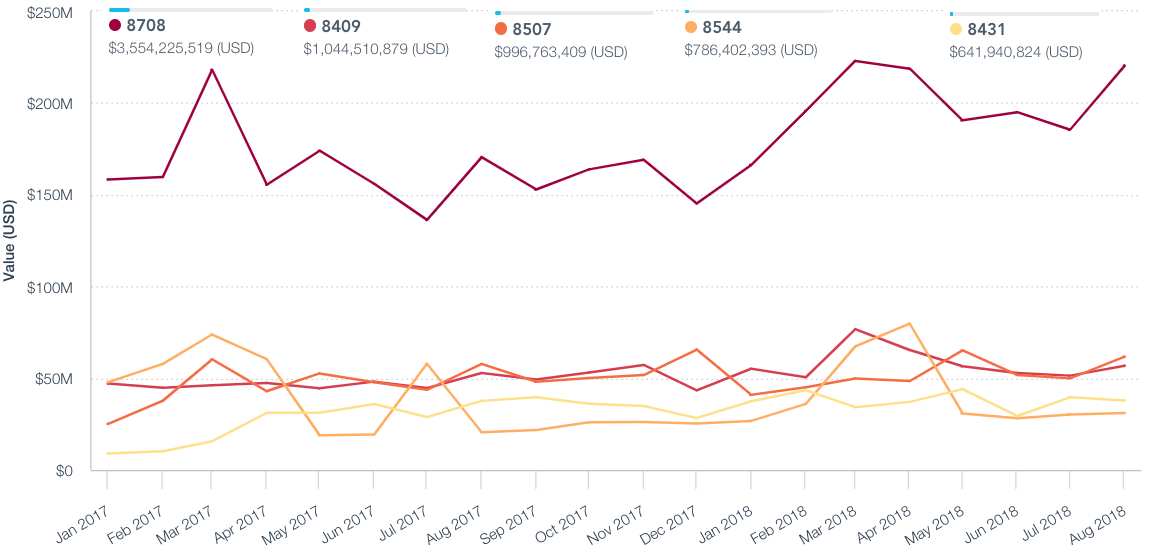

Panjiva data shows Mexican exports to the U.S. and Canada in the past 12 months by truck reached $266 billion, or 70.3% of the total. Shipments by sea grew more quickly, at 26.3% vs. 6.8% for truck-carriage, in part due to the tight trucking market in the U.S. as outlined in Panjiva research of August 20.

Source: Panjiva

Border disruptions and capacity shortages may lead more long-distance haulage – i.e. to states beyond those contiguous to Mexico – to shift to rail or sea depending on access to infrastructure (i.e. ports of major rail interchanges) and timeliness.

The largest industries using trucking exports from Mexico to states north of California, New Mexico, Arizona and Texas including the automotive industry (components worth $2.22 billion, engines worth $668 million and batteries worth $429 million) as well as capital goods (heavy machinery parts worth $442 million and cables worth $728 million).

Source: Panjiva

The most significant consignees in those industries, which may be better off pursuing alternative transportation modes assuming supply chain timing requirements allow, are Johnson Controls ($507 million), Caterpillar ($341 million) and ZF Transmissions ($174 million).

Source: Panjiva