The Chinese government, via the Ministry of Commerce has vowed to take “comprehensive measures combining quantity and quality” against duties on Chinese exports worth up to $250 billion by the U.S. As outlined in Panjiva research of June 19 the U.S. duties are a reaction to the Trump administration’s section 301 review of Chinese IP practices (the $50 billion) and preemptive retaliation should China choose to react to the initial phase of duties ($200 billion)

The question is whether China has the wherewithal to retaliate in kind, or not.

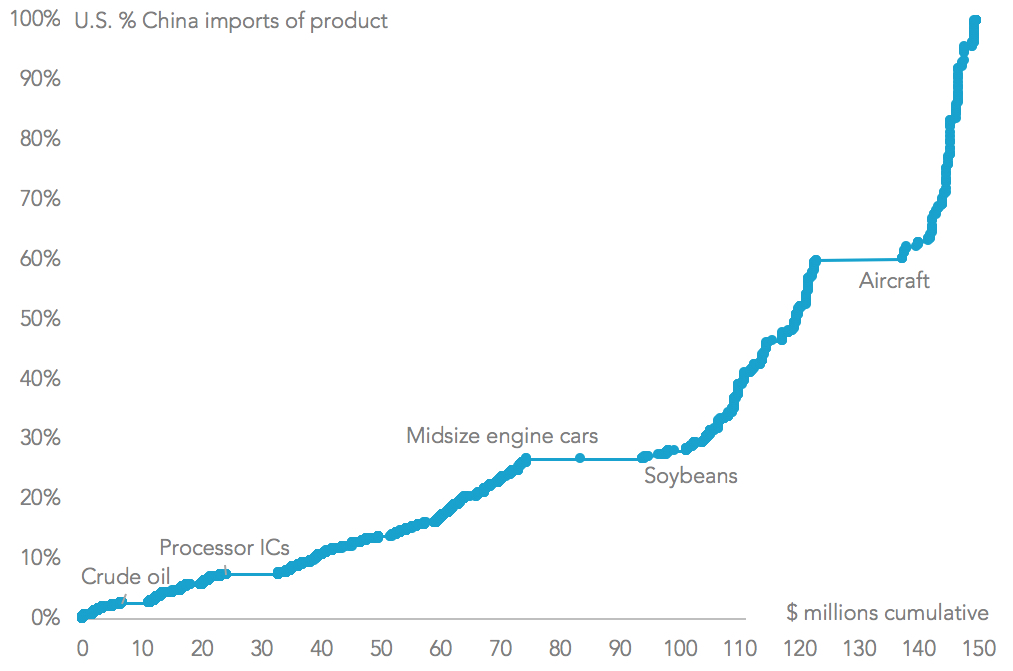

While China has a lower value of products to target at $150 billion in the 12 months to February 28 vs. $442 billion is is also less dependent on the U.S. for those products. China’s imports from the U.S. are equivalent to 8.2% of all Chinese imports, whereas for the U.S. the ratio is 21.6%.

Panjiva data shows for China’s imports from the U.S. vs. globally shows it also has a number of acute leverage points including aircraft ($14.2 billion, 60.0% from the U.S.), midsize engine cars ($10.3 billion, 26.7%), soybeans ($9.1 billion, 26.7%), processor chips ($8.6 billion, 7.4%) and crude oil ($4.5 billion, 7.4%).

Assuming a 33% dependency is “sustainable” through other foreign and domestic sources that would given China $107 billion or products it could “easily” retaliate against. Yet, with three of these products (cars, beans and oil) already covered by existing retaliation proposals China will need to either (a) extend the list to cover almost all imports and / or (b) greatly increase duties on existing products.

Source: Panjiva

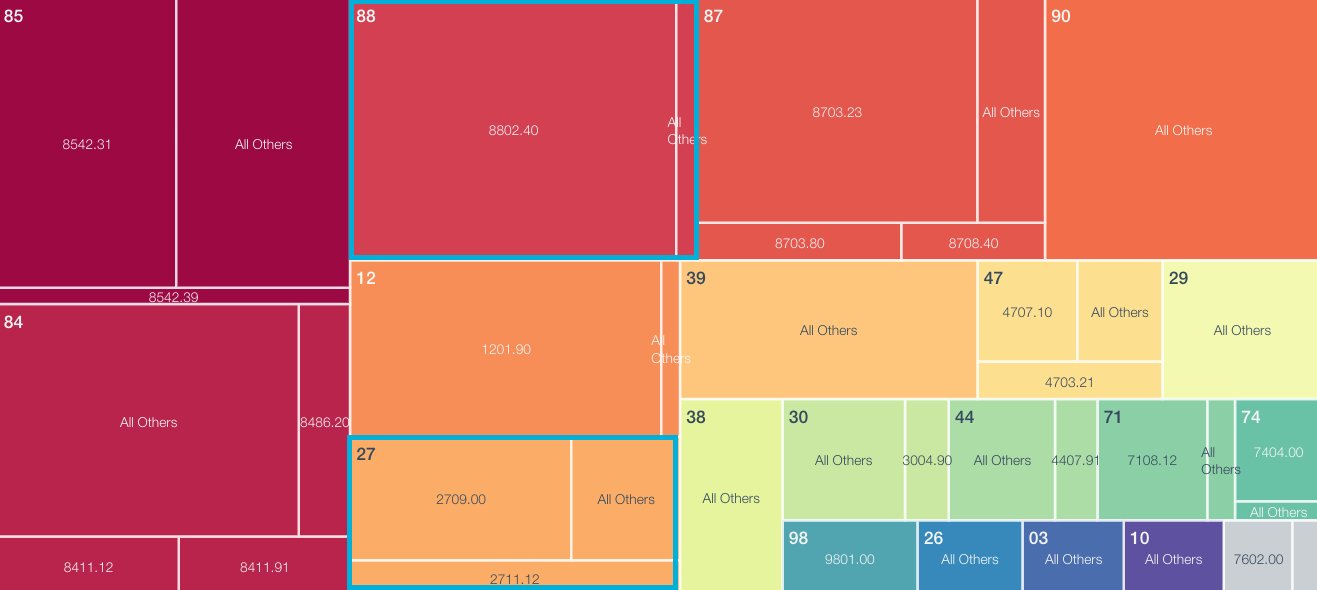

A wider application of duties could be calculated from America’s initial proposals which include 25% tariffs on $50 billion of products to be potentially following by 10% on $200 billion of products – i.e. $32.5 billion of sanctions.

China could, therefore, provide symmetric retaliation with 21.7% tariffs on all U.S. products. That could also be extended to a bar on Chinese state corporations buying U.S. products outright. For example an end to purchases of American aerospace products by redirecting sales to Canada and the EU (which would also help Comac) and energy products (including oil, petroleum and coal) would reduce purchases from the U.S. by $23.7 billion.

That would then require blanket duties of just 7.5% on all other Chinese imports from the U.S. to meet the $32.5 billion targeted by the U.S. There are of course a great many combinations of bans and blanket duties that could be applied in an escalating tariff war between the two countries.

Source: Panjiva