Smart speakers are becoming an increasingly ubiquitous part of everyday life, as highlighted by announcements at CES of products like the Samsung Galaxy Home Mini, Royole Mirage, and Klipsch Bar 40G. This trend continues from the previous two years’ shows, as flagged in Panjiva’s research reviewed of Jan. 2018.

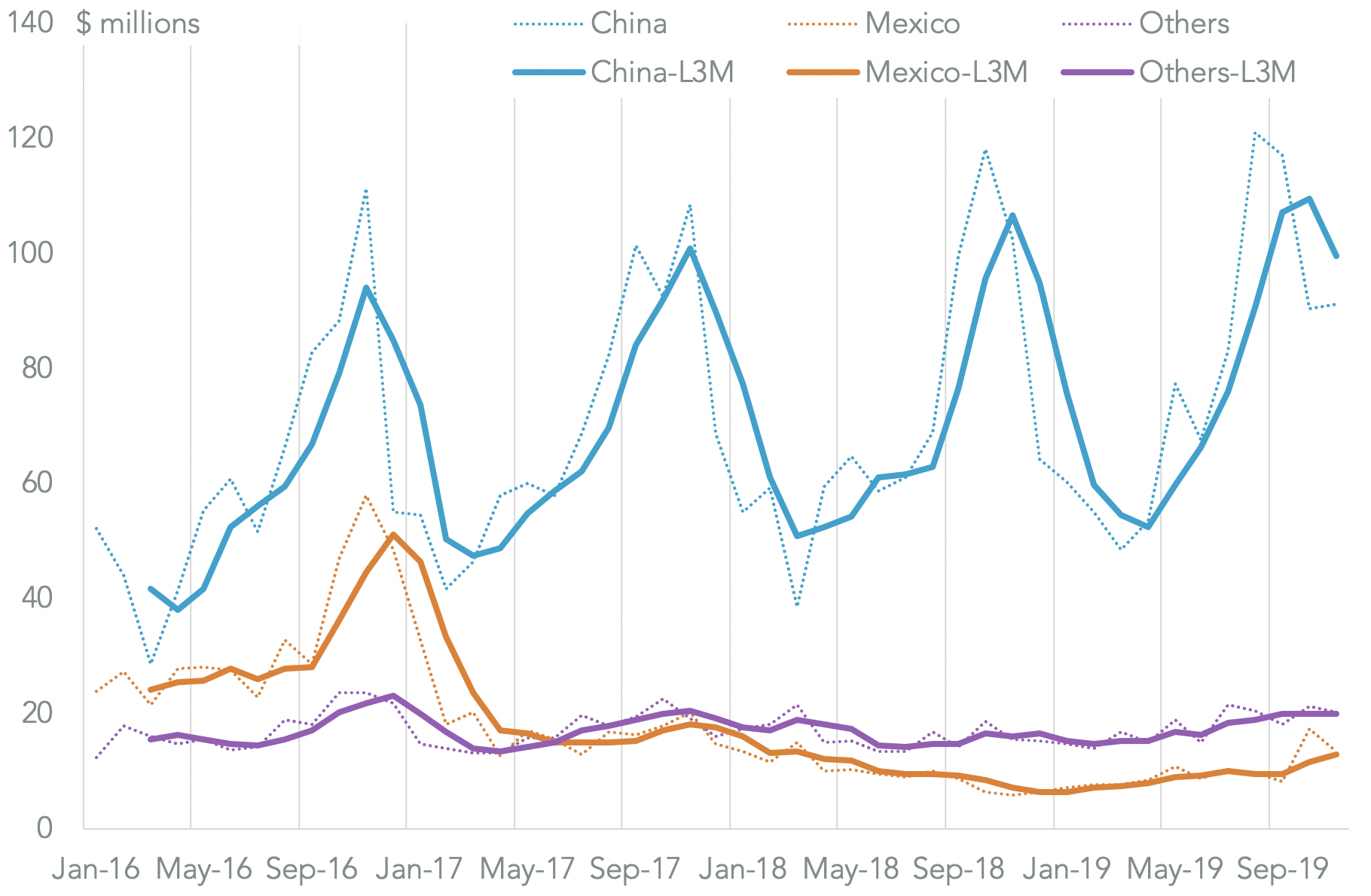

China has long been the main source of U.S. imports of multi-speaker units, with shipments increasing seasonally for the holidays. Trade tensions with China culminated with these speakers being included in the so-called list 4A of products where tariffs of 15% were applied from September.

The tariffs have reprofiled shipments during the year, but do not appear to have hurt overall demand. Panjiva’s data shows total U.S. imports of speakers climbed 18.2% year over

year in the Jul. 1 to Nov. 30 period that’s normally associated with holiday season sales. Imports from China surged 19.7% higher over the same period, but fell by 6.7% year over year in the three months to Nov. 30 – the height of peak season – due to stockpiling ahead of the expected implementation of tariffs in Jan. 2019 that eventually only took place in Sept. 2019.

China’s suppliers have likely lost ground to exporters from Mexico whose exports jumped 84.7% in the past three months while those from the rest of the world climbed 23.7%.

Source: Panjiva

A recent case involving Sonos draws attention to the importance of intellectual property in these new products. In a petition filed with the U.S. International Trade Commission, Sonos alleges that Alphabet infringed on their patents for smart speakers. U.S. seaborne imports associated with Sonos grew by 13.6% year over year in the 12 months to Nov. 30. That may indicate a rebound from increased competition by Alphabet among others – Sonos imports fell by 5.8% year over year in the three months including Nov 2018.

In the meantime, as outlined in Panjiva’s research of Aug. 13, the firm has started realigning its supply chain after the imposition of list 4A tariffs. China accounted for 84.1% of shipments associated with Sonos in the 12 months to Nov. 30, while Taiwan has emerged as an alternative supplier increasing to 14.2% of imports over the same time period.

Source: Panjiva

Recreating this analysis in S&P Global Market Intelligence Xpressfeed

Searching for sonos shipments on Xpressfeed is best done by utilizing a goods shipped search, as some shipments are imported by Sonos’ distributors. First create queries for each year of data you want to cover, and join in the additional goods shipped data. Use these queries as a subquery, and filter that subquery for the word ‘SONOS’ or for consignees named ‘Sonos’. Note that these are case sensitive, and the goods descriptions are in all caps. Further processing for presentation was done using Excel.