The U.S. Deputy Chief of Mission to the WTO, Christopher Wilson, flagged on November 1 the potential for the U.S. and Sri Lanka to expand their trade, subject to Sri Lanka further reducing its barriers to trade. Tax support for exporting industries was cited as an example from a recent WTO report.

Sri Lanka desperately needs an increase in its trade. Exports fell 4.4% in July, the most recently published figure according to Central Bank data, the 17th straight drop. This was the result of a drought cutting harvests of water-intensive products including tea and rubber according to the Economist Intelligence Unit.

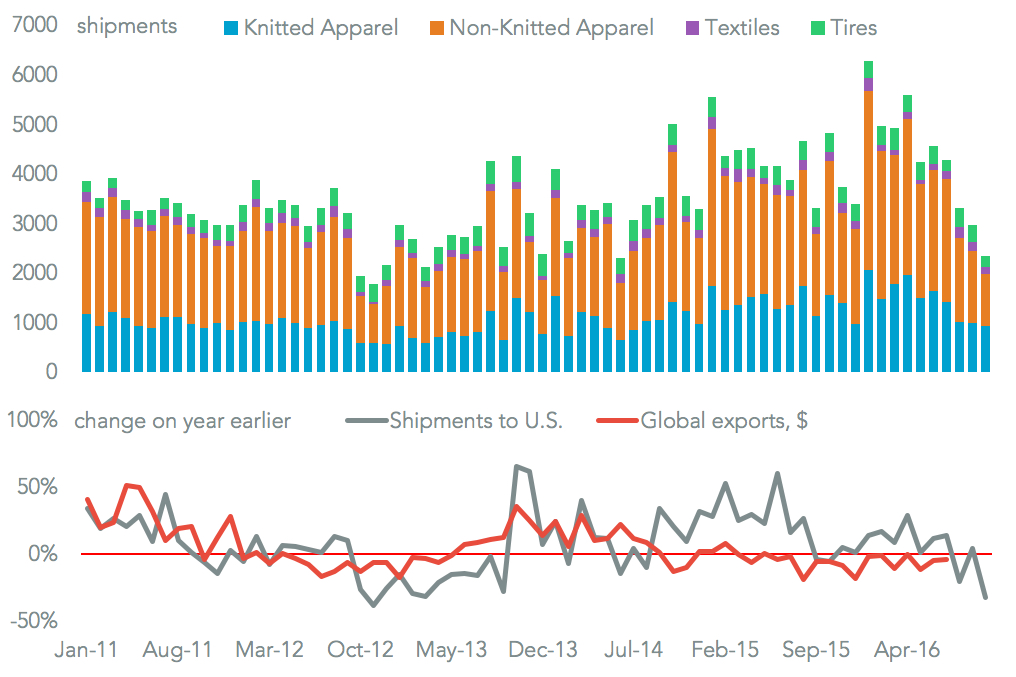

Exports to the U.S. have historically focussed on apparel and rubber products – principally tires – Panjiva data shows. In the 12 months to October 31 61.7% of seaborne exports to the U.S. were apparel, 6.9% tires and 2.5% other textiles. Sri Lanka’s export woes appear to have continued. Shipments to the U.S. were a third less in October than a year earlier, with the three month total 18.6% lower than the same period a year earlier.

Source: Panjiva

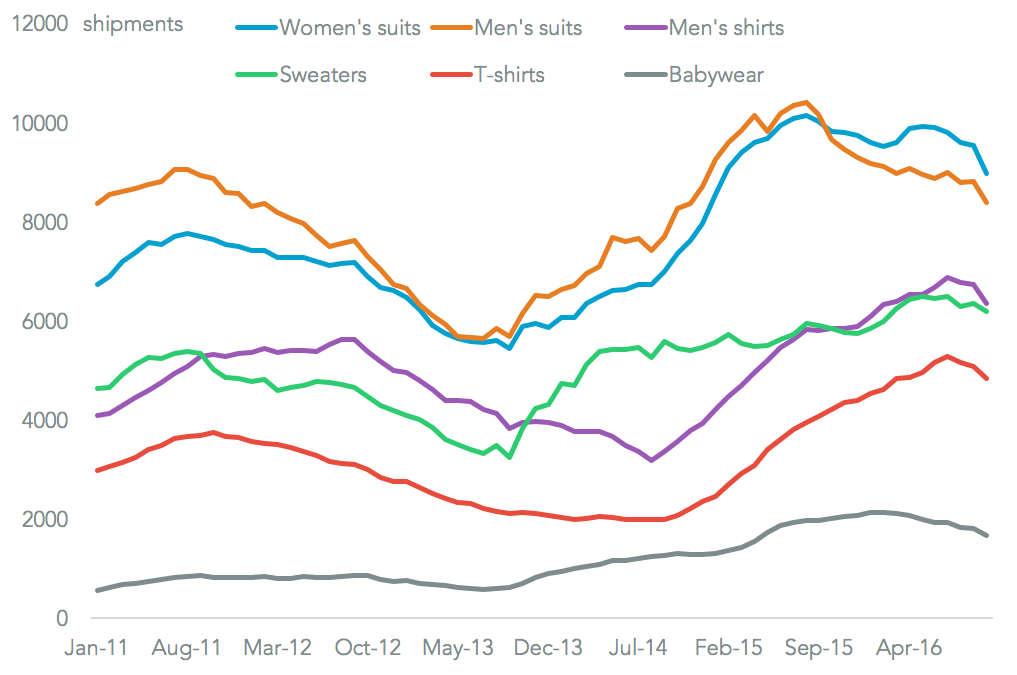

Looking at apparel specifically, the main source of declines in exports to the U.S. have been in suits and ensembles. On a 12 month rolling basis exports of men’s suits were 13.2% lower at the end of October than the same period a year earlier and were 19.4% below their August 2015 peak. Shipments of women’s ensembles and suits were 11.6% lower.

By contrast, shipments of separates have been doing better. The 12 month shipments of T-shirts were 15.1% higher than a year earlier, shirts 8.4% better and exports of sweaters were 6.1%. That said, these categories to may have seen a peak recently.

Source: Panjiva

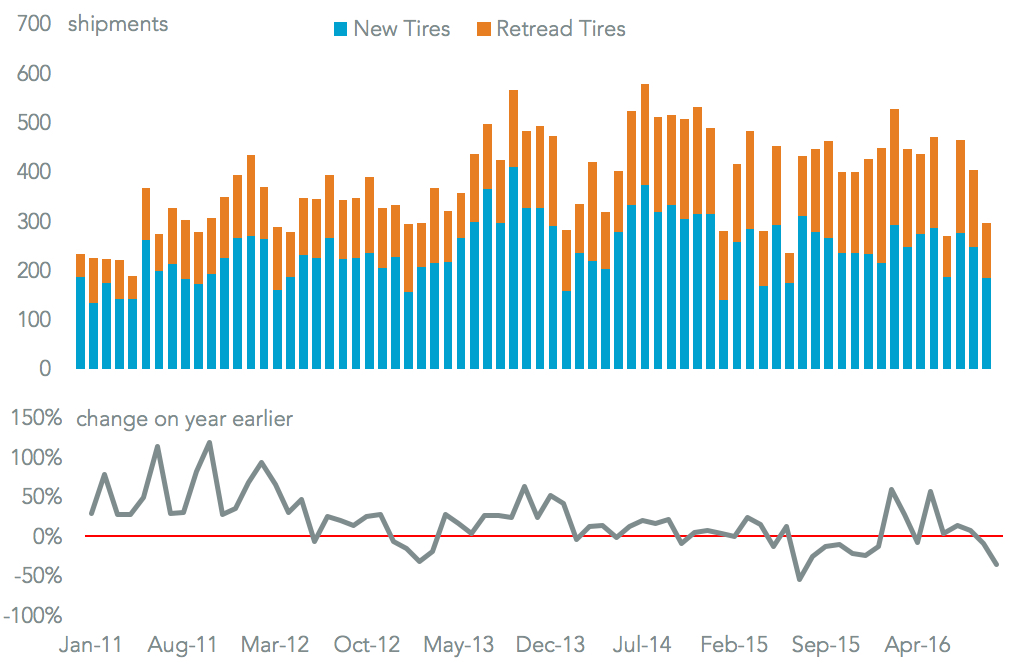

Exports of tires are dominated by off-road tire manufacturer Camso. Total tire exports to the U.S. were 36.1% lower than a year earlier in the month of October, and 0.6% lower on a 12 month average basis. This likely reflects reduced rubber availability for the weather-related reasons already highlighted. A 8.5% increase in shipments of retread tires on a rolling 12 month basis vs. a year earlier compared to a 6.1% drop for originals supports this hypothesis.

Source: Panjiva

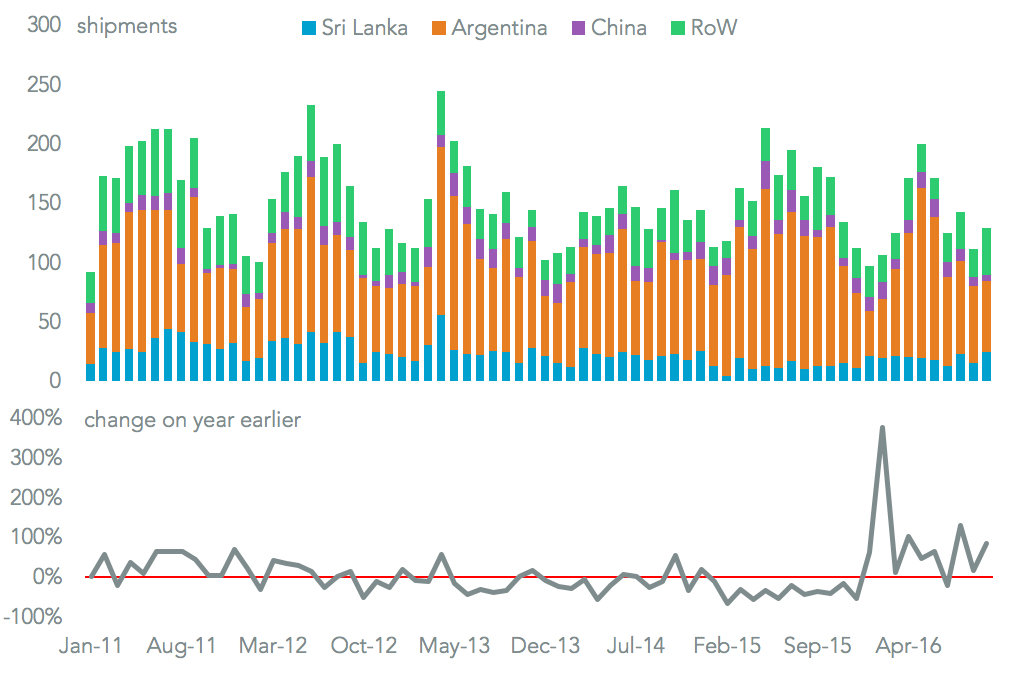

Sri Lanka’s most significant export globally by value was tea. The country was the third largest supplier to the U.S. in the 12 months to October 31. This has been one area of success for Sri Lanka. U.S. tea imports fell 15.3% on a rolling annual basis in October, yet imports from Sri Lanka increased 31.9%. There may be a limit to this success, however, if tea production suffers from the ongoing drought.

Source: Panjiva