The White House has rejected the finding of the Commerce Department’s section 232 “national security” review of U.S. imports of uranium. The Trump administration’s order also establishes a working group to consider other options for a domestic supply chain.

The decision is unlikely to have a read across to the ongoing section 232 review of the automotive industry which, as flagged in Panjiva’s 3Q 2019 Outlook, is due to reach a conclusion in November. For one thing the review of uranium has direct defense implications, and for another it ties into the wider and ongoing critical minerals review being carried out by the administration.

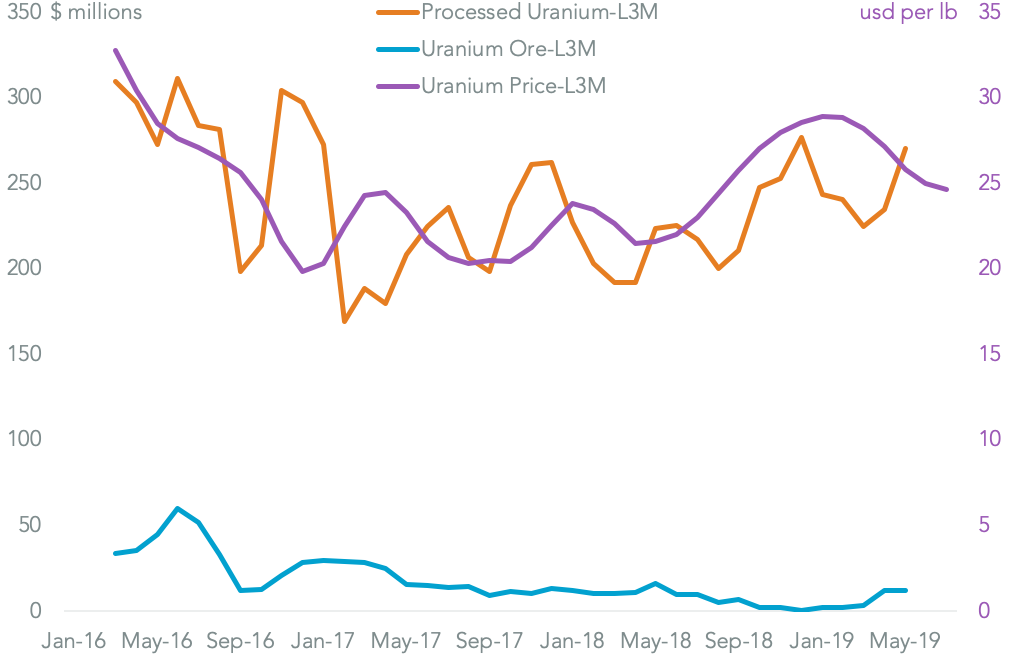

Panjiva data shows that imports of processed uranium has increased 20.8% year over year to match a similar increase in USD per pound of uranium of 19.6% year over year in the three months ending in May, Panjiva analysis of S&P Global Market Intelligence data shows.

Conversely, imports of uranium ore have dropped by 20% year over year over the same three months, giving credence to U.S. Commerce’s conclusion that the domestic market is losing the ability to process critical minerals.

Source: Panjiva

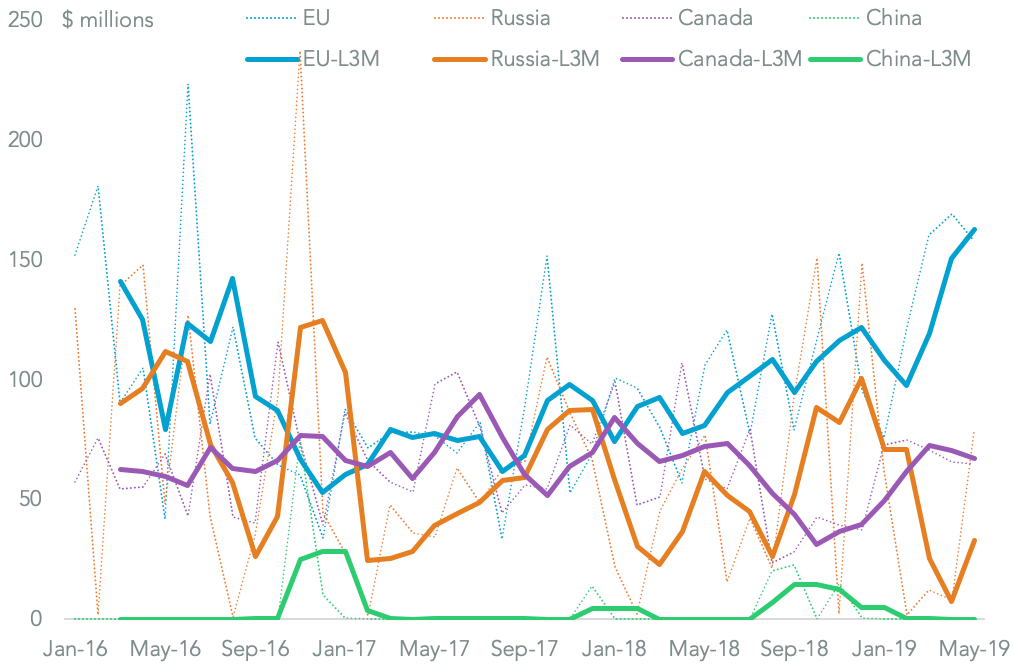

Looking at the main countries importing uranium to the U.S., EU countries combined supplied $1.2 billion in 2018, or 44.6% of total imports. EU countries were also able to increase imports to the U.S. by 106.4% year over year in the three months ending in May. Major importers by sea of uranium products since the start of 2016 have included Cameco and Honeywell’s ConverDyn subsidiary.

Another gainer was China, while only accounting for 2.2% of imports in 2018, grew 31.5% year over year over the same period. Russia’s seaborne imports of uranium – including those by EDF’s Framatome – fell by 46.6% year over year after accounting for 25.2% of seaborne imports in 2018.

Finally, Canada’s exports fell 7.2% year over year, relatively stable compared to the other trading partners, also providing 24.7% of imported uranium.

Source: Panjiva