The British Parliament has completed the second of three votes that could result in the Brexit process being delayed. A majority of 53.5% supported a motion to reject a no-deal Brexit

No deal rules out for now but still face significant tariff increases following a decision by 61.8% of MPs to reject the government’s proposed Brexit withdrawal agreement.

That still leaves the possibility of a no-deal Brexit – even if there is a delay there is no guarantee a vote can be reached. In any event if the U.K. does eventually leave the EU there will be tariffs applied to both EU and international imports until free trade agreements are signed.

To that end HM Revenue and Customs have published a British tariff code. Panjiva analysis shows that of the 10,233 tariff categories only 9.6% – or 979 lines – are not zero-rated including both itemized, volumetric and non-tariff code related items. That would suggest the government is keen to minimize the immediate impact of higher tariffs, though it may also diminish the negotiating position of the government when negotiating deals.

The automotive sector has the lowest proportion of duty free lines with just 118 of 202 lines, or 58.4% of the total, having zero ratings. The average tariff rate of 4.4% across the board includes 22.0% duties on trucks and 10.0% on cars.

That’s in common with the EU and, as outlined in Panjiva’s research of Mar. 12, sets the scene for tough negotiations with both the EU and U.S. for the future of the automotive industry. Other sectors with below average tariff-free treatment include food – particularly fish and prepared meats – as well as energy and apparel.

Source: Panjiva

While 92.5% of apparel lines are zero-rated there are tariff rates of 12.0% on a wide range of mens’ and womens’ suits, shirts and underwear. The decision to protect British industry against European competition may be the result of recent import performance.

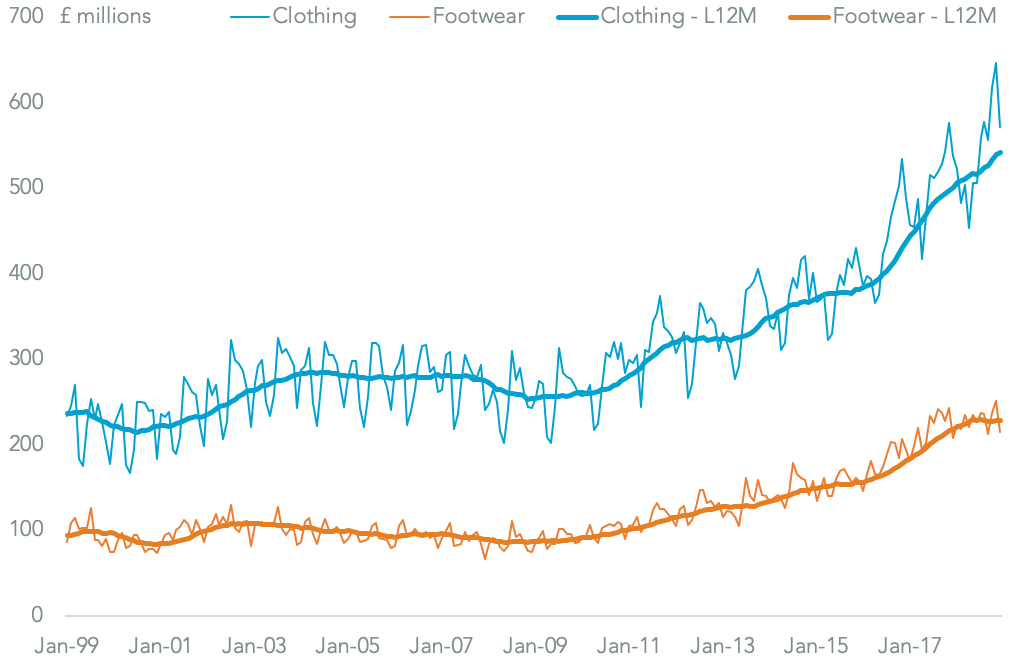

Panjiva analysis of official data shows imports of clothing and footwear from the EU were worth 9.26 billion pounds ($12.3 billion) in 2018. Imports of clothing from the EU climbed 8.1% year over year in 2018 versus a 4.4% drop in shipments from other countries, while imports of footwear from the EU climbed 5.2% versus a 9.9% drop from all other suppliers.

Source: Panjiva